What's Happening?

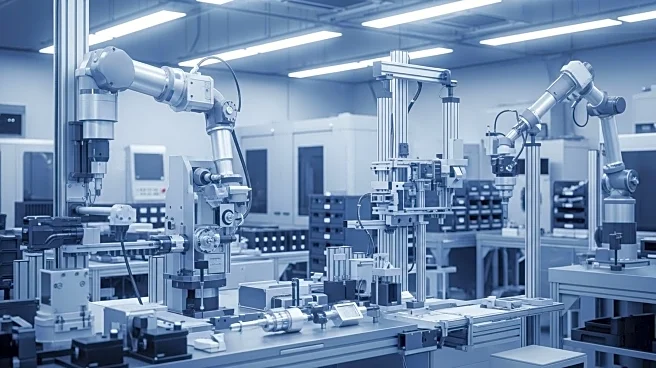

Taiwan Semiconductor Manufacturing, Applied Materials, and Chart Industries have been identified as promising manufacturing stocks to watch. These companies are involved in producing physical goods through processes like assembly, fabrication, and machining. Taiwan Semiconductor focuses on integrated circuits, Applied Materials provides manufacturing equipment for semiconductors, and Chart Industries designs equipment for gas and liquid molecules. These stocks are part of the industrial sector and are sensitive to economic growth and consumer demand.

Why It's Important?

Manufacturing stocks like Taiwan Semiconductor, Applied Materials, and Chart Industries are significant for investors seeking exposure to global production trends. These companies are pivotal in their respective industries, influencing technological advancements and economic growth. Their performance can impact supply chain dynamics and commodity prices, affecting broader market conditions. Investors must consider risks such as supply chain disruptions and price volatility when investing in these stocks.

What's Next?

The focus on these manufacturing stocks may lead to increased investor interest and potential market movements. As these companies continue to innovate and expand their operations, they could influence industry standards and drive technological advancements. Investors will likely monitor economic indicators and consumer demand trends to assess the future performance of these stocks.

Beyond the Headlines

The emphasis on manufacturing stocks highlights the importance of industrial innovation and its role in economic development. Ethical considerations regarding environmental impact and sustainable practices in manufacturing may become more prominent, influencing corporate strategies and investor decisions.