What is the story about?

What's Happening?

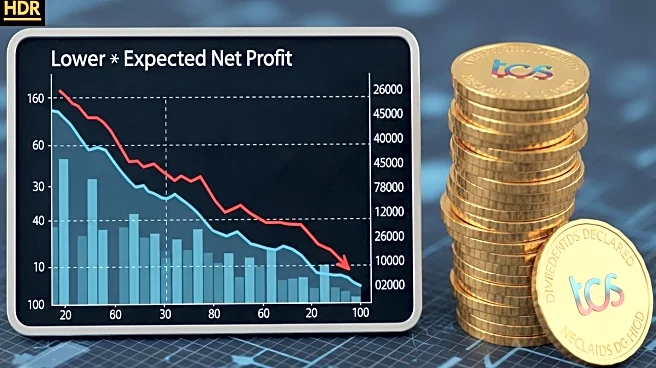

Tata Consultancy Services (TCS) has released its second-quarter financial results, reporting a net profit of ₹12,075 crore, which is below the street estimate of ₹12,573 crore. The company has declared a dividend of ₹11 per share, with the record date set for October 15, 2025, and payment on November 4, 2025. The company's revenue and earnings reflect a stable performance in the BFSI sector, while life sciences, communications, and technology sectors face variable demand. TCS's focus on key sectors is part of its strategy to navigate market challenges and leverage growth opportunities.

Why It's Important?

The results are crucial as they provide insights into TCS's financial health and operational performance. The lower-than-expected net profit may raise concerns among investors about the company's ability to meet market expectations. However, the dividend declaration indicates a positive outlook and commitment to shareholder value. The performance across different sectors highlights the diverse challenges and opportunities TCS faces, which could impact its strategic decisions and market positioning. Investors and industry analysts will be keenly observing how TCS adapts to these dynamics.

What's Next?

TCS is likely to continue focusing on stabilizing its performance across key sectors, potentially adjusting its strategies to address demand variability. The upcoming dividend payment will be a focal point for investors, reflecting the company's financial strategy and shareholder engagement. Future earnings reports will be critical in assessing TCS's ability to overcome market challenges and achieve growth targets.