What's Happening?

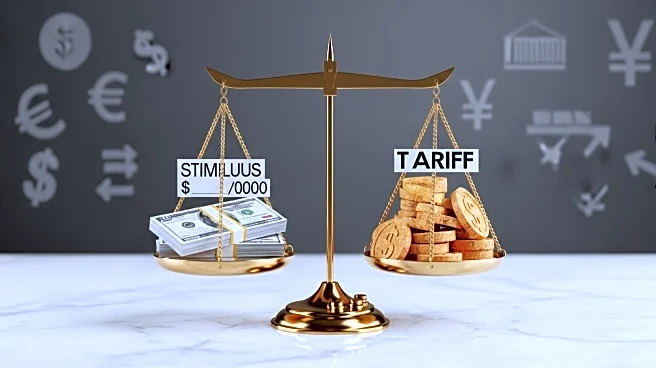

President Trump has announced a proposal to distribute stimulus checks to Americans, funded by revenues from tariffs on imported goods. In an interview with One America News, Trump suggested that these checks could range from $1,000 to $2,000. The proposal is part of a broader strategy to manage the national debt, which has surpassed $38 trillion. Trump believes that the economic growth spurred by his tariff policies will help reduce the debt and allow for a distribution of tariff revenues to citizens, akin to a dividend. The administration has reportedly generated approximately $215 billion from these tariffs since April.

Why It's Important?

The proposal to use tariff revenues for stimulus checks could have significant implications for U.S. economic policy and public finances. If implemented, it could provide direct financial relief to Americans, potentially boosting consumer spending and economic activity. However, experts warn that Trump's tax policies, including the One Big Beautiful Bill, could increase the national debt by over $4 trillion in the next decade, potentially offsetting the benefits of tariff revenues. The proposal also highlights ongoing debates about fiscal policy and the role of tariffs in economic strategy.

What's Next?

For the proposal to be realized, it would require congressional approval. Republican Senator Josh Hawley previously introduced the American Worker Rebate Act, which aimed to distribute tariff revenues as stimulus checks, but the bill has not yet passed. The divided Congress, which recently failed to prevent a government shutdown, may pose challenges to advancing this legislation. The future of the proposal will depend on political negotiations and the ability to garner sufficient support.

Beyond the Headlines

The proposal raises questions about the ethical and economic implications of using tariff revenues for direct payments to citizens. It could set a precedent for how trade policy impacts domestic economic relief efforts. Additionally, the reliance on tariffs as a revenue source may affect international trade relations and economic diplomacy.