What's Happening?

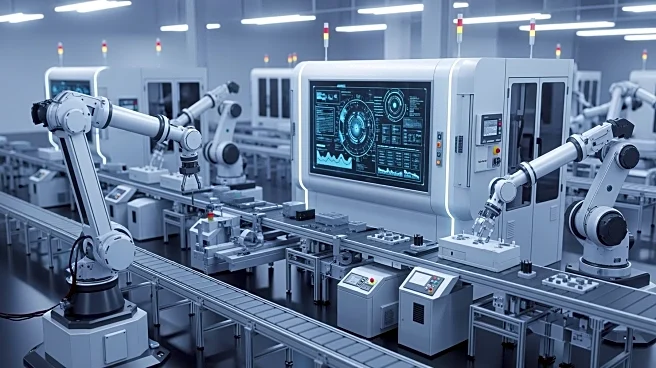

Societe Generale has identified three major catalysts for reshoring stocks in 2026, which involve the return of companies' overseas operations to the United States. The catalysts include the One Big Beautiful

Bill, which offers 100% bonus depreciation for qualified properties acquired after January 2025, massive investment activity totaling $8.9 trillion, and cyclical lows in non-residential construction spending. The firm has constructed the SG US Reshoring thematic equity index, selecting S&P 500 companies with significant revenue from the American market and exposure to critical industries.

Why It's Important?

The reshoring trend could significantly impact the U.S. economy by boosting domestic manufacturing and investment. Companies benefiting from the trend may experience improved cash flow and tax savings, enhancing their financial performance. The focus on industries such as defense, semiconductors, and energy could lead to increased innovation and competitiveness in these sectors. The reshoring movement aligns with broader economic policies aimed at strengthening U.S. industrial capabilities and reducing reliance on foreign production.

What's Next?

With the Federal Reserve expected to continue lowering rates, construction spending is anticipated to accelerate, further supporting the reshoring trend. Companies included in the SG US Reshoring thematic equity index, such as Eaton, Emerson Electric, Nucor, and Ameren, are positioned to benefit from increased investment and construction activity. The ongoing reshoring efforts may prompt other companies to reevaluate their global operations and consider relocating production to the U.S., potentially reshaping the landscape of American manufacturing.