What's Happening?

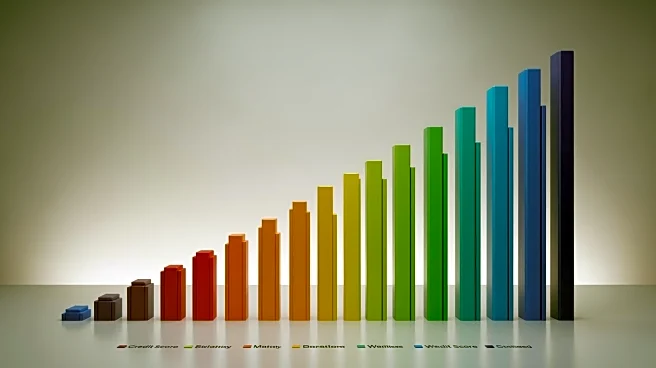

A recent study by the Fair Isaac Corporation (FICO) reveals significant variations in average credit scores across U.S. states. States with lower average scores have seen greater declines, indicating economic

struggles among residents. Mississippi reported the lowest average score at 677, while Minnesota had the highest at 743. The FICO score, ranging from 300 to 850, assesses creditworthiness, with scores below 579 considered 'very poor.' The report highlights the impact of credit scores on life milestones, such as securing loans for homes or cars.

Why It's Important?

Credit scores play a crucial role in financial decision-making, affecting individuals' ability to secure loans and favorable terms. The disparities in average scores across states reflect broader economic challenges and can influence local economies. States with lower scores may face higher rates of loan rejections and less favorable terms, impacting residents' financial stability and economic growth. Understanding these variations can help policymakers and financial institutions tailor strategies to improve credit access and support economic development.

What's Next?

As economic conditions evolve, credit scores may continue to fluctuate, impacting consumer behavior and lending practices. Efforts to improve financial literacy and access to credit-building resources could help address disparities in credit scores. Policymakers may consider initiatives to support individuals in states with lower scores, potentially boosting economic resilience and growth. Monitoring these trends will be essential for stakeholders aiming to enhance financial inclusion and stability.

Beyond the Headlines

The report underscores the importance of credit scores in shaping economic opportunities and challenges. It highlights the need for ongoing research and policy interventions to address systemic issues affecting credit access and financial health. The findings may prompt discussions on alternative credit assessment methods and the role of financial education in improving credit outcomes.