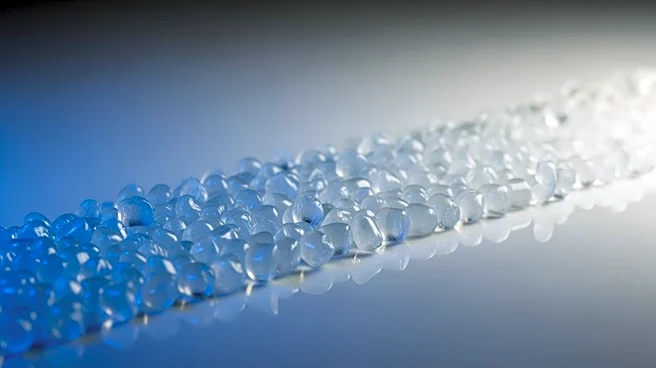

What's Happening?

China's increasing self-sufficiency in polypropylene (PP) production is reshaping global market dynamics. The country has aggressively expanded its PP production capacity, leading to a significant reduction

in its import needs. This shift has resulted in substantial sales turnover losses for China's top import partners, including South Korea, Taiwan, and Saudi Arabia. For instance, China's imports from South Korea dropped from 1.3 million tonnes to 550,000 tonnes, with prices falling from $1,187 per tonne to $866 per tonne. This trend is part of a broader 'race to the bottom' in the global PP market, where China could potentially become a net exporter in certain PP grades.

Why It's Important?

The shift in China's PP market has significant implications for global trade and economic relations. As China reduces its reliance on imports, countries that previously supplied large volumes of PP to China are experiencing economic impacts, including reduced sales and lower prices. This change could lead to increased competition in non-China markets as these countries seek new buyers for their products. Additionally, the potential for China to become a net exporter in PP could further intensify global competition, affecting pricing and market shares for producers worldwide. This development underscores the broader trend of China's growing influence in global industrial markets.

What's Next?

As China continues to expand its PP production capabilities, other countries may need to adjust their strategies to remain competitive. This could involve seeking new markets, diversifying product offerings, or investing in technological advancements to improve efficiency and reduce costs. Additionally, trade policies and international relations may be influenced as countries respond to China's changing role in the global PP market. Stakeholders, including businesses and policymakers, will need to monitor these developments closely to adapt to the evolving market landscape.