What's Happening?

TKMS, a leading warship builder, has made a successful stock market debut, achieving a valuation of 6.3 billion euros ($7.35 billion), surpassing its parent company Thyssenkrupp. The spin-off is part of Thyssenkrupp's

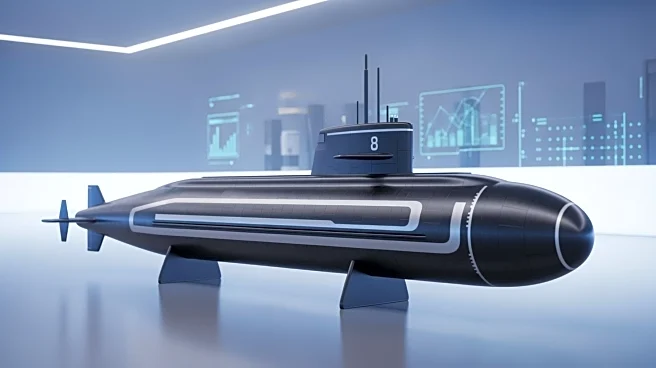

strategy to simplify its structure and capitalize on the growing demand for defense assets. TKMS's shares soared, reflecting investor interest in defense sector opportunities. The company, headquartered in Kiel, Germany, is the world's largest builder of non-nuclear submarines and frigates. The spin-off allows TKMS to finance acquisitions and expand its operations amid rising geopolitical tensions and increased defense spending.

Why It's Important?

The successful debut of TKMS highlights the increasing investor appetite for defense sector investments, driven by geopolitical tensions such as Russia's invasion of Ukraine. As defense budgets in core markets are expected to more than double, TKMS is well-positioned for growth, potentially influencing global defense procurement strategies. The spin-off provides TKMS with the flexibility to pursue strategic acquisitions and partnerships, contributing to the consolidation of Europe's defense industry. Thyssenkrupp's restructuring reflects broader trends in corporate strategy, focusing on core operations and unlocking shareholder value.

What's Next?

TKMS is set to expand its operations, with plans to secure a major submarine order in Canada and participate in the German navy's F127 frigate program. The company is also negotiating a submarine contract with India, positioning itself for further growth in the defense sector. As defense budgets continue to rise, TKMS's strategic positioning could lead to increased market share and influence in global defense procurement. Thyssenkrupp's ongoing discussions with India's Jindal Steel International over the sale of its steel division may result in further corporate restructuring and strategic realignment.

Beyond the Headlines

The spin-off of TKMS underscores the importance of corporate restructuring in adapting to changing market dynamics and unlocking shareholder value. As defense spending increases, companies like TKMS are likely to play a crucial role in shaping the future of maritime security and defense strategies. The transaction highlights broader trends in the defense industry, including increased focus on technological innovation and strategic partnerships. TKMS's ability to innovate and expand its capabilities could have long-term implications for global defense strategies and industry competition.