What's Happening?

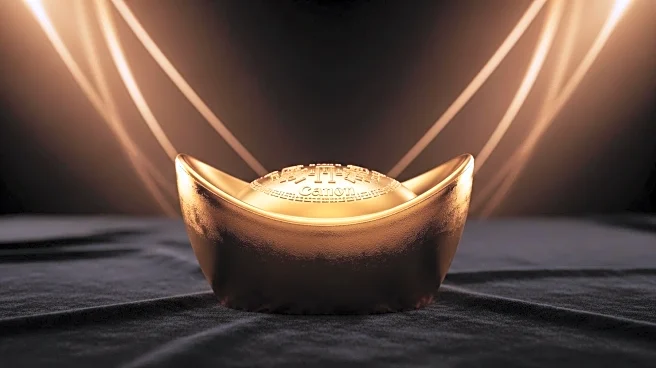

Gold prices have reached a new record high, surpassing $4,100 per ounce, driven by renewed trade tensions between the United States and China and expectations of interest rate cuts. Spot gold increased by 2.2% to $4,106.48 per ounce, with US gold futures for December settling 3.3% higher at $4,133. This surge in gold prices is attributed to geopolitical and economic uncertainties, robust central bank buying, and the prospect of lower interest rates. President Trump recently reignited trade tensions with China, ending a temporary truce between the two largest economies. Traders are anticipating a 97% probability of a 25-basis-point Federal Reserve rate cut in October and a 100% chance for December, which typically benefits non-yielding assets like gold.

Why It's Important?

The rise in gold prices reflects broader economic and geopolitical uncertainties, impacting investors and financial markets. As a safe-haven asset, gold tends to perform well in low-interest-rate environments, attracting investors seeking stability amid volatile market conditions. The ongoing US-China trade tensions could further influence global economic dynamics, affecting industries reliant on international trade. Additionally, the Federal Reserve's potential interest rate cuts may have significant implications for monetary policy and economic growth, influencing investment strategies and market sentiment.

What's Next?

Analysts predict that gold prices could continue their upward momentum, potentially reaching $5,000 by the end of 2026. However, a near-term correction might be necessary for a sustainable long-term uptrend. The Federal Reserve's upcoming decisions on interest rates will be closely monitored, as they could impact gold's performance and broader economic conditions. Market participants will also watch for developments in US-China trade relations, which could further affect commodity prices and global trade dynamics.

Beyond the Headlines

The surge in gold prices highlights the complex interplay between geopolitical events and financial markets. It underscores the importance of safe-haven assets in times of uncertainty, reflecting investor sentiment and risk management strategies. The situation also raises questions about the long-term impact of trade tensions on global economic stability and the role of central banks in navigating these challenges.