What is the story about?

What's Happening?

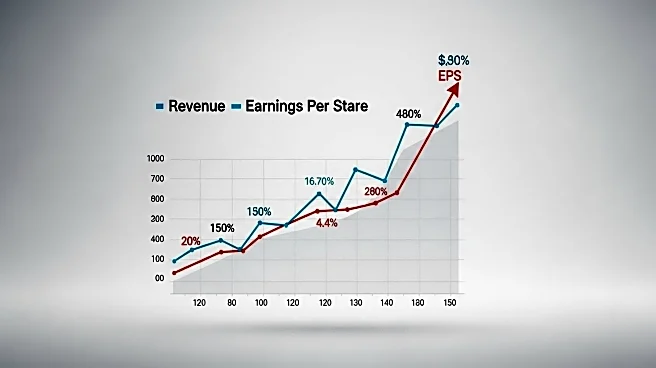

Three F Co Ltd has released its consolidated earnings estimates for the fiscal year ending February 28, 2026. The company forecasts revenues of 14.90 billion yen, an increase from the previous forecast of 14.50 billion yen. Operating and recurring profits are both projected at 1.34 billion yen, up from 1.10 billion yen in the previous forecast. Net profit is expected to reach 350 million yen, compared to 250 million yen previously. The earnings per share (EPS) is anticipated to be 46.21 yen, a significant rise from the earlier estimate of 33.01 yen.

Why It's Important?

The updated earnings forecast from Three F Co Ltd indicates a positive outlook for the company, suggesting improved financial performance and potential growth. This could impact investor confidence and market valuation, as higher revenues and profits often lead to increased stock prices. The rise in EPS is particularly noteworthy as it reflects enhanced profitability per share, which is a key metric for shareholders. The forecast may also influence strategic decisions within the company, including potential expansions or investments.

What's Next?

As Three F Co Ltd moves forward with its fiscal plans, stakeholders will be closely monitoring the company's performance against these forecasts. Investors may react to these projections by adjusting their portfolios, potentially increasing demand for Three F Co Ltd's shares. The company might also explore opportunities to capitalize on its improved financial outlook, such as entering new markets or enhancing product offerings. Additionally, analysts and market observers will likely scrutinize the company's quarterly reports to assess its progress toward achieving these targets.

Beyond the Headlines

The earnings forecast not only reflects Three F Co Ltd's current financial health but also its strategic positioning in the market. The company's ability to increase its revenue and profitability amidst economic fluctuations could signal robust management practices and effective operational strategies. This development may also have implications for the broader industry, as competitors might reassess their own forecasts and strategies in response to Three F Co Ltd's performance.