What's Happening?

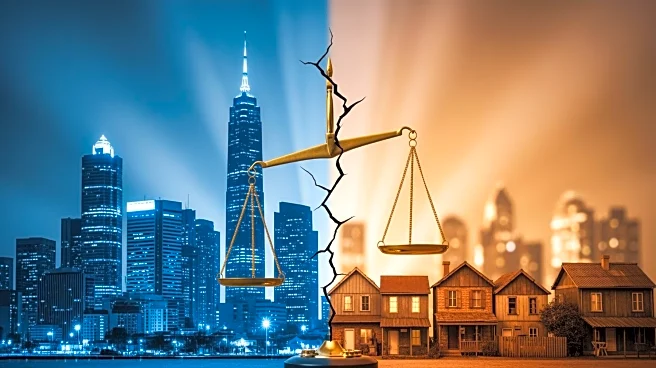

Martin Schlegel, President of the Swiss National Bank (SNB), indicated that the central bank might consider implementing negative interest rates if the Swiss franc continues to appreciate due to geopolitical tensions. The Swiss franc is often seen as

a safe haven currency, and its strength can pose challenges for the Swiss economy by making exports more expensive. Schlegel also highlighted the importance of an independent U.S. Federal Reserve for maintaining global economic stability, suggesting that central bank policies in major economies have far-reaching implications.

Why It's Important?

The potential move to negative interest rates by the SNB underscores the challenges central banks face in managing currency strength and economic stability amid global uncertainties. For the U.S., the independence of the Federal Reserve is crucial in maintaining confidence in the global financial system. The SNB's considerations reflect broader concerns about the impact of geopolitical tensions on currency markets and the global economy. Negative rates could influence international investment flows and economic growth, affecting U.S. businesses with exposure to Swiss markets.

What's Next?

If the SNB decides to implement negative rates, it could lead to increased volatility in currency markets and impact global financial conditions. The U.S. Federal Reserve may need to monitor these developments closely, as changes in Swiss monetary policy could have ripple effects on global interest rates and economic activity. Additionally, geopolitical tensions that influence currency valuations may prompt further discussions among central banks on coordinated policy responses to stabilize markets.