What is the story about?

What's Happening?

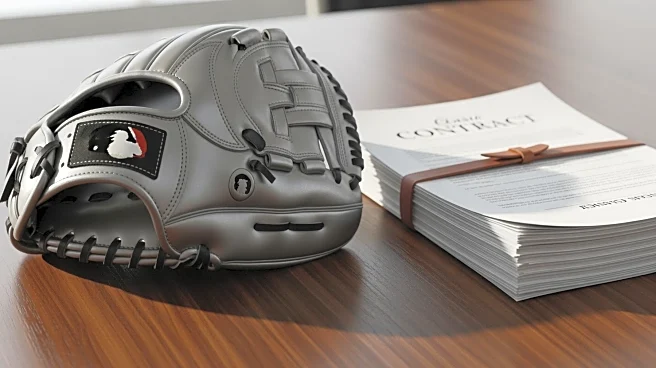

The six largest U.S. banks, including JPMorgan Chase, Goldman Sachs, Morgan Stanley, Bank of America, Citigroup, and Wells Fargo, are expected to report stronger third-quarter earnings, driven by a resurgence in investment banking activities. This rebound follows a period of stagnation earlier in the year due to tariff announcements by President Trump. The easing of regulations and anticipated rate cuts have facilitated a surge in mergers and acquisitions, with JPMorgan experiencing one of its busiest summers for dealmaking. Analysts have noted a significant increase in announced deals, with global M&A reaching $2.6 trillion, marking the highest level for the first seven months of the year since the pandemic-era peak in 2021. Trading revenues are also expected to grow, with robust equities trading volumes and elevated activity in fixed income, currencies, and commodities.

Why It's Important?

The anticipated increase in profits for major U.S. banks highlights the resilience of the economy and the potential for growth in the financial sector. The rebound in investment banking and trading activities suggests a positive outlook for the industry, which could lead to increased investor confidence and further economic stability. The strong performance of these banks may also influence their strategies regarding capital management and share buybacks, impacting shareholders and the broader market. Additionally, the health of U.S. consumers and borrowers, as indicated by continued loan payments, suggests a stable financial environment, which is crucial for sustaining economic growth.

What's Next?

As the banks prepare to announce their third-quarter results, investors will closely monitor their economic commentary and expectations for future investment banking and trading activities. Analysts will pay attention to any changes in the credit environment, consumer confidence, and business confidence, which could affect the banks' performance in the coming quarters. The banks' management commentary on loan demand and growth plans will be crucial in determining the trajectory of the financial sector. Furthermore, the lifting of Wells Fargo's asset cap by regulators and its subsequent growth plans will be a focal point for investors.

Beyond the Headlines

The resurgence in investment banking and trading activities may have broader implications for the U.S. economy, potentially leading to increased job creation and economic expansion. The easing of regulations and rate cuts could stimulate further mergers and acquisitions, driving innovation and competitiveness in various industries. However, analysts remain cautious about the sustainability of this revival, with concerns about potential defaults in smaller firms and static deposit levels and loan growth on the consumer side.