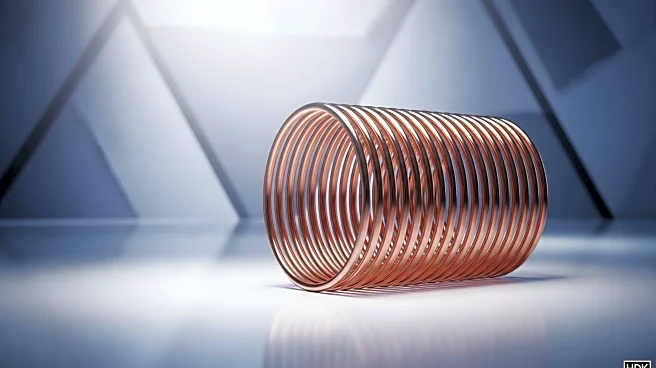

What's Happening?

The U.S. Commodity Futures Trading Commission (CFTC) has released its latest Commitments of Traders (COT) report for copper, highlighting a significant divergence between speculative positioning and long-term structural demand. As of August 26, 2025, non-commercial speculative long positions in copper futures totaled 26,230 contracts, showing a slight increase from the previous week. However, this masks a broader trend of declining speculative longs, which hit an 11-month low the prior week. Commercial entities, including producers and institutional hedgers, maintain a 45.7% short position, reflecting concerns over potential oversupply and regulatory volatility. Copper prices have risen 6.22% year-to-date, driven by energy transition demand and infrastructure modernization, yet speculative investors remain cautious due to regulatory uncertainty, including a 50% U.S. import tariff on copper.

Why It's Important?

The COT data underscores a broader reallocation of capital between metals/mining and manufacturing sectors. Copper's rising importance in electric vehicles (EVs), renewable energy systems, and AI infrastructure is reshaping investment flows. U.S.-based copper producers and the Copper ETF (COPX) are benefiting from policy tailwinds like the Inflation Reduction Act (IRA), which provides tax incentives for domestic production. Conversely, manufacturing sectors, particularly EV producers, face rising copper-linked costs, prompting a shift toward cost-sensitive alternatives like recycled copper. This shift is mirrored in speculative positioning, where energy sectors like crude oil and natural gas have seen declining prices and speculative short positions reach historical lows.

What's Next?

The COT report highlights two key investment themes: policy-driven opportunities in mining and hedging manufacturing sector risks. Copper miners aligned with IRA incentives, such as Gunnison Copper (GCOP), are positioned to benefit from reduced capital costs and increased competitiveness. Investors in manufacturing firms, particularly EV producers, should consider short-term hedging strategies using copper futures or options to mitigate price volatility. The International Energy Agency (IEA) projects copper demand to grow at 12% annually through 2030, reinforcing its central role in the energy transition. However, short-term volatility necessitates a dual approach: leveraging policy tailwinds in mining while hedging manufacturing sector risks.

Beyond the Headlines

The CFTC's COT data serves as a barometer for capital reallocation, offering both challenges and opportunities. Investors who balance speculative caution with long-term fundamentals will be well-positioned to navigate this dynamic market. By adopting a diversified, policy-aware strategy, investors can capitalize on sector rotation dynamics and position themselves for long-term growth.