What's Happening?

Recent data from FICO's Score Credit Insights reveals that the average U.S. credit score has dropped to 715, marking the largest decline since the Great Recession. This decrease is attributed to persistent inflation and a sluggish job market, which have

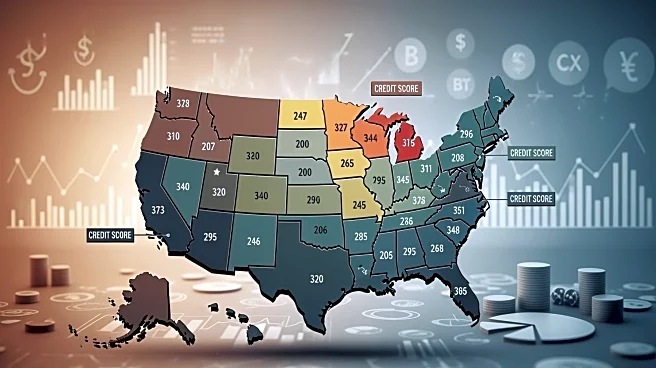

led to increased credit utilization and decreased on-time payments. The analysis highlights a growing divide among consumers, with middle-range credit scores shrinking and both 'excellent' and 'poor' score brackets expanding. Vermont boasts the highest average FICO score at 740, while Mississippi has the lowest at 677. The report links credit scores to median income and employment rates, noting that states with higher incomes and lower unemployment rates tend to have better credit scores.

Why It's Important?

The decline in average credit scores has significant implications for U.S. consumers, affecting their ability to secure loans, favorable interest rates, and housing opportunities. As credit scores are a critical component of financial health, the widening gap between high and low scores could exacerbate economic inequality. States with lower scores may face challenges in attracting investment and fostering economic growth, while individuals in these areas may struggle with higher borrowing costs and limited financial mobility.

What's Next?

As economic conditions continue to fluctuate, consumers may need to adopt strategies to improve their credit scores, such as reducing credit utilization and ensuring timely payments. Policymakers might consider addressing underlying economic issues, such as income disparity and employment rates, to help stabilize credit scores across regions. Financial institutions could also play a role by offering educational resources and support to consumers aiming to improve their credit health.

Beyond the Headlines

The credit score disparities highlight broader socio-economic issues, including the impact of student loan debt and regional economic policies. As credit scores influence access to financial resources, they can perpetuate cycles of poverty and limit opportunities for upward mobility. Addressing these disparities may require comprehensive policy interventions that focus on education, employment, and income equality.