What is the story about?

What's Happening?

Venmo and PayPal are set to launch a new feature allowing direct payments between the two platforms starting in November. This development comes after PayPal's acquisition of Venmo in 2014, addressing a long-standing user demand for interoperability between the two major payment apps. Users will be able to search for Venmo contacts from the PayPal app and vice versa, facilitating seamless cash transfers. While the specifics regarding potential fees for this service remain unclear, the introduction of this feature marks a significant step in enhancing user experience and convenience. Additionally, Venmo plans to update its privacy settings, enabling users to control who can find them via PayPal, which is crucial for maintaining user security and preventing potential scams.

Why It's Important?

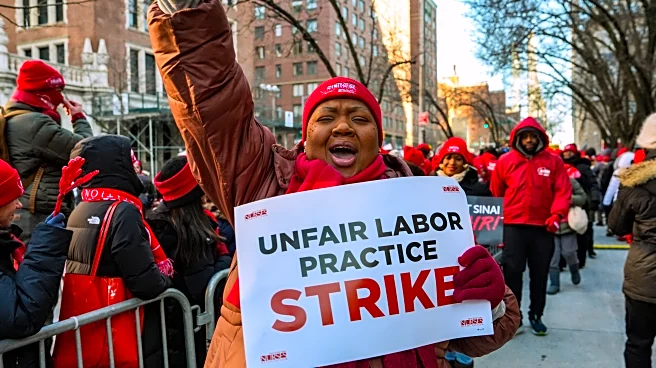

The integration of direct payment capabilities between Venmo and PayPal is a significant advancement in the digital payment industry, potentially impacting millions of users who rely on these platforms for financial transactions. This feature simplifies the process of transferring money, which could lead to increased usage and user satisfaction. The move also highlights the growing trend of interoperability among financial services, which can drive competition and innovation in the sector. However, the introduction of this feature raises concerns about privacy and security, necessitating careful management of user data to prevent misuse. Businesses and individuals who frequently use these apps stand to benefit from the enhanced convenience, while PayPal and Venmo could see increased engagement and transaction volumes.

What's Next?

As the new feature rolls out in November, users will need to update their apps to access the direct payment functionality. Venmo's planned update to privacy settings will be crucial in ensuring user security, allowing individuals to restrict who can locate them via PayPal. Stakeholders, including users and cybersecurity experts, will likely monitor the implementation closely to assess its impact on privacy and security. PayPal and Venmo may also face scrutiny regarding any fees associated with the new service, which could influence user adoption rates. The success of this integration could prompt other financial platforms to explore similar interoperability features, potentially reshaping the digital payment landscape.

Beyond the Headlines

The introduction of direct payments between Venmo and PayPal could have broader implications for the digital payment industry, encouraging other companies to pursue similar integrations. This trend towards interoperability may lead to increased collaboration among financial services, fostering innovation and potentially reducing costs for consumers. However, it also raises ethical considerations regarding data privacy and the responsibility of companies to protect user information. As digital payments become more interconnected, the need for robust cybersecurity measures becomes increasingly critical to safeguard against fraud and unauthorized access.