What's Happening?

Taiwan Semiconductor Manufacturing Company Ltd. (TSMC) has seen significant changes in its institutional holdings, with JTC Employer Solutions Trustee Ltd reducing its stake by 12.8% in the second quarter. Despite this reduction, TSMC remains a major

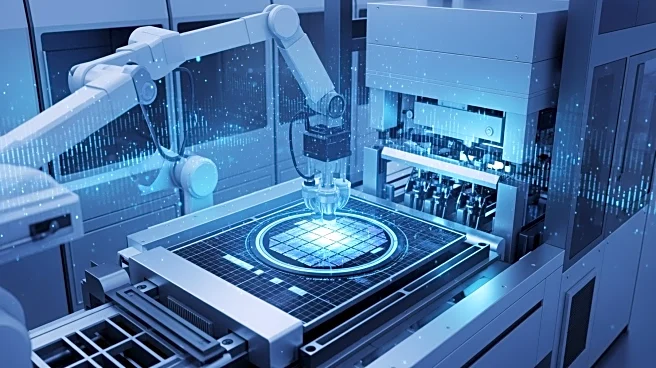

holding for JTC, accounting for 1.3% of its portfolio. Other institutional investors have also adjusted their positions, with DekaBank Deutsche Girozentrale increasing its stake by 0.9% and Hudson Edge Investment Partners Inc. boosting its holdings by 10.1%. Quantbot Technologies LP notably increased its position by 452.2% in the first quarter. These movements reflect a broader trend of institutional interest in TSMC, which is a leading manufacturer of integrated circuits and semiconductor devices globally.

Why It's Important?

The adjustments in institutional holdings of TSMC highlight the company's pivotal role in the semiconductor industry, which is crucial for technological advancements and economic growth. As a major player, TSMC's performance and strategic decisions can significantly impact global supply chains, especially in sectors reliant on semiconductor technology such as electronics, automotive, and telecommunications. The increased interest from institutional investors suggests confidence in TSMC's growth prospects, driven by its innovative manufacturing processes and expanding market presence. This could lead to enhanced investor confidence and potentially influence stock market dynamics, affecting stakeholders across various industries.

What's Next?

TSMC's future developments may include further expansion of its manufacturing capabilities and strategic partnerships to meet the growing demand for advanced semiconductor technologies. The company's recent earnings report, which exceeded analyst expectations, indicates strong financial health and potential for continued growth. TSMC's guidance for the fourth quarter and its increased dividend payout reflect optimism about future performance. Stakeholders will likely monitor TSMC's strategic moves, including potential collaborations and technological innovations, which could shape the semiconductor industry's trajectory and influence global economic trends.

Beyond the Headlines

The semiconductor industry is facing geopolitical challenges, particularly concerning export controls and technology transfers. TSMC's operations span multiple regions, including Taiwan, China, and the United States, making it susceptible to international trade policies and regulatory changes. The company's ability to navigate these complexities while maintaining its competitive edge could have long-term implications for its market position and the broader industry landscape. Additionally, TSMC's focus on sustainable practices and technological innovation may contribute to shifts in industry standards and consumer expectations.