What's Happening?

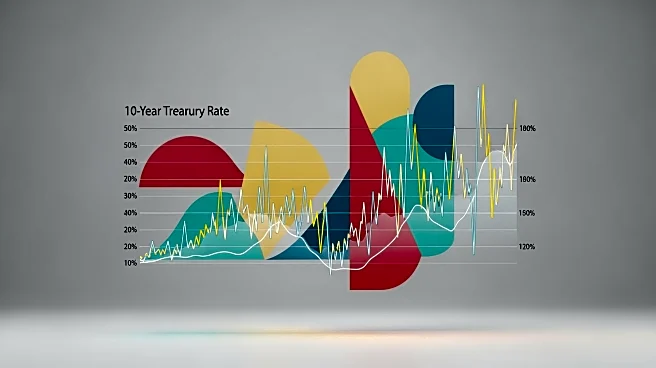

The 10-year Treasury rate is a closely watched financial indicator, reflecting the interest rate on 10-year Treasury securities. Treasury Secretary Bessent emphasized its importance in a recent interview,

noting its impact on government financing costs and economic policy. The rate affects both public and private sector borrowing costs, serving as a benchmark for various interest rates, including mortgages and corporate bonds. The high level of accumulated government debt and rising interest rates have increased interest payments, which now constitute a significant portion of federal spending.

Why It's Important?

The 10-year Treasury rate is crucial for understanding macroeconomic policy and market dynamics. It influences borrowing costs across the economy, affecting household spending and business investment. As a benchmark for interest rates, changes in the 10-year Treasury yield can signal shifts in economic conditions and investor confidence. The rate's impact on government financing costs highlights the importance of fiscal policy decisions in managing debt levels and ensuring economic stability.

What's Next?

Policymakers may need to consider strategies to manage the impact of the 10-year Treasury rate on borrowing costs and economic growth. Efforts to stabilize interest rates and address fiscal sustainability will be important for maintaining confidence in U.S. debt securities. The potential for changes in monetary policy and economic conditions will be closely monitored by investors and financial institutions.

Beyond the Headlines

The ethical and legal dimensions of fiscal policy decisions may become more prominent as stakeholders consider the implications of rising debt levels. Long-term shifts in investor behavior and global perceptions of U.S. economic stability could influence the role of the dollar as a reserve currency. The balance between fiscal responsibility and economic growth will be a key consideration for policymakers and financial markets.