What's Happening?

Intel has reported a third-quarter revenue of $13.65 billion, surpassing analyst expectations of $13.14 billion. Despite this positive revenue performance, Intel's adjusted earnings per share of 23 cents did not align with analyst estimates. The company

anticipates fourth-quarter revenue to be around $13.3 billion, slightly below forecasts, with adjusted earnings per share expected to meet current forecasts at 8 cents. Analysts have expressed concerns over Intel's Foundry business, which requires a $100 billion capital investment and has yet to secure a major customer. The Foundry division reported a 2% year-over-year loss in sales, totaling $4.2 billion. Intel's stock has increased by 8% in premarket trading and has rallied 25% this year.

Why It's Important?

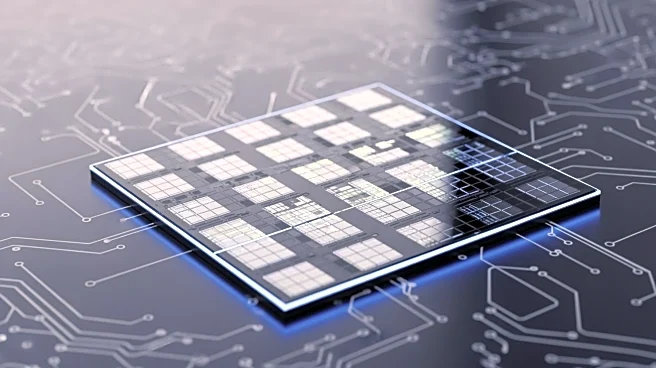

Intel's performance is crucial for the tech industry, as it remains a significant player in the semiconductor market. The company's ability to exceed revenue expectations suggests strong demand for its products, which could influence market dynamics and competition, particularly with AMD. However, the challenges faced by Intel's Foundry business highlight potential risks for investors and the company's long-term strategy. The substantial investment required and lack of major customers could impact Intel's profitability and market position. Analysts' mixed ratings reflect uncertainty about Intel's future, particularly regarding its competitive positioning and ability to innovate in a rapidly evolving tech landscape.

What's Next?

Intel's future will likely involve strategic decisions regarding its Foundry business and efforts to secure major customers. The company may need to reassess its investment strategy and explore partnerships to enhance its competitive edge. Analysts suggest that Intel's stock may remain event-driven, with potential announcements on foundry partners, AI collaborations, and new products influencing investor sentiment. The company's focus on fundamentals and addressing supply constraints will be critical in maintaining market confidence and achieving long-term growth.

Beyond the Headlines

The challenges faced by Intel's Foundry business could have broader implications for the U.S. semiconductor industry, particularly in terms of manufacturing capabilities and technological innovation. Intel's efforts to secure partnerships and improve its competitive positioning may influence industry standards and drive advancements in chip technology. Additionally, the company's performance could impact investor confidence in the tech sector, affecting stock market trends and investment strategies.