What's Happening?

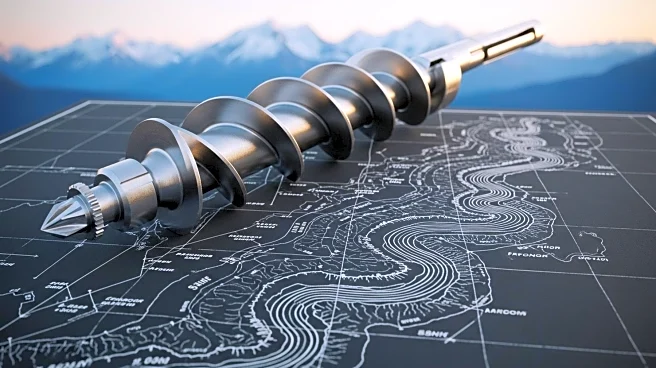

The Trump administration has taken a significant step in the mining sector by acquiring a 10% stake in Canadian mining company Trilogy Metals. This move was accompanied by an executive order to permit the construction of an access road to Alaska's Ambler Mining District, a region rich in copper, silver, gold, lead, cobalt, and other strategic metals. The administration's investment amounts to $35.6 million, with additional warrants for a potential 7.5% stake. The Ambler Access Project aims to facilitate mining operations in northern Alaska, a decision previously opposed by the Biden administration due to environmental and tribal community concerns. Measures such as caribou protection policies are planned to mitigate environmental impacts. The news has led to a significant surge in Trilogy Metals' stock, which jumped over 230% before settling at a 211% increase.

Why It's Important?

This development underscores the Trump administration's focus on bolstering domestic supply chains for critical minerals, which are essential for various industries, including technology and defense. By investing in Trilogy Metals and facilitating access to the Ambler Mining District, the administration aims to reduce reliance on foreign sources, particularly China, which dominates the global market for these minerals. The move is part of a broader strategy to secure resources necessary for the energy transition and technological advancements, such as electric vehicles and AI infrastructure. The investment in Trilogy Metals aligns with previous stakes in companies like Lithium Americas and MP Materials, highlighting a concerted effort to strengthen U.S. mineral production capabilities.

What's Next?

The construction of the Ambler Access Road is expected to proceed, although a specific timeline has not been established. The project will likely face scrutiny from environmental groups and native tribal communities concerned about its impact. The Trump administration's continued investments in resource extraction companies suggest further initiatives to enhance domestic mineral production. Stakeholders in the mining and technology sectors will be closely monitoring developments, as the availability of critical minerals is crucial for future growth and innovation. The administration's actions may also prompt discussions on balancing economic interests with environmental and social responsibilities.

Beyond the Headlines

The Trump administration's investment strategy reflects a geopolitical dimension, aiming to counter China's influence in the minerals market. By securing domestic sources, the U.S. seeks to enhance its strategic autonomy and reduce vulnerabilities in supply chains critical to national security. The focus on critical minerals also highlights the intersection of economic policy and environmental concerns, as the demand for these resources grows with the global energy transition. The administration's approach may influence future policy decisions regarding resource management and international trade relations.