What's Happening?

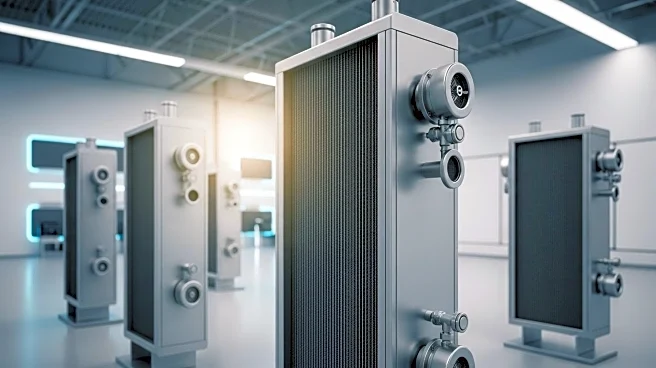

KRN Heat Exchangers and Refrigeration Ltd, an Indian company specializing in heat exchangers, has reported a significant growth in its Q1 financial results. The company saw a 20.36% increase in net sales, driven by strong domestic and international demand. KRN has recently commenced operations at its new facility in Neemrana, Rajasthan, which is expected to boost production capacity significantly. The company has also secured approval under the PLI scheme, receiving incentives for its white goods production. This expansion is part of KRN's strategy to enhance its market presence and cater to the growing demand for energy-efficient HVAC systems.

Why It's Important?

KRN's growth is indicative of the increasing demand for energy-efficient solutions in the HVAC industry, driven by global trends towards sustainability and efficiency. The company's expansion and strategic investments position it well to capitalize on these trends, potentially leading to increased market share and profitability. The approval under the PLI scheme provides financial support for further development, enhancing KRN's competitive edge. As data centers and AI technologies expand, the demand for efficient cooling solutions is expected to rise, offering KRN opportunities for growth in new sectors. This development highlights the importance of innovation and strategic planning in maintaining industry leadership.

What's Next?

KRN plans to increase its production capacity utilization significantly over the next few years, aiming for full capacity utilization by FY 27. The company is also looking to expand its presence in the data center cooling segment, anticipating substantial growth in this area due to global AI expansion plans. KRN's management is optimistic about future growth prospects, with expectations of increased demand for its products. The company is likely to continue focusing on innovation and expanding its client base to sustain its growth trajectory. Investors and industry analysts are closely watching KRN's performance, with positive expectations for its long-term profitability.