What's Happening?

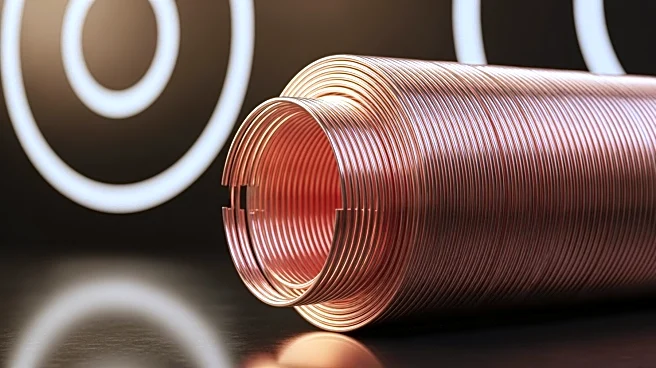

Copper prices are nearing record highs, trading close to $11,000 a ton due to significant supply disruptions at major global mines. The price surge follows a rebound from a sell-off in April, which was influenced by trade tensions escalated by the Trump

administration. A key factor in the current supply challenges is the suspension of operations at Freeport-McMoRan Inc.'s Grasberg mine in Indonesia after a fatal mudslide. Grasberg, the world's second-largest copper mine, remains halted, with Freeport expected to update investors on its status next month. Additionally, aluminum prices have reached their highest since May 2022, supported by supply caps in China.

Why It's Important?

The rise in copper prices has significant implications for industries reliant on the metal, such as construction and electronics, potentially increasing costs for manufacturers and consumers. The disruptions at major mines highlight vulnerabilities in global supply chains, which could lead to further price volatility. Investors are closely monitoring these developments, as they affect commodity markets and related sectors. The situation underscores the impact of geopolitical tensions and environmental factors on resource availability and pricing.

What's Next?

Freeport-McMoRan Inc. is expected to provide an update on the Grasberg mine's status, which could influence copper market dynamics. Stakeholders, including investors and industries dependent on copper, will be watching for any resolution to the supply disruptions. The broader commodity market may experience continued volatility, with potential implications for global trade and economic stability.

Beyond the Headlines

The copper supply crisis raises questions about the sustainability and resilience of global mining operations. Environmental and safety concerns, as evidenced by the mudslide at Grasberg, may prompt calls for stricter regulations and improved safety measures. The situation also highlights the need for diversification in sourcing critical materials to mitigate risks associated with concentrated supply chains.