What's Happening?

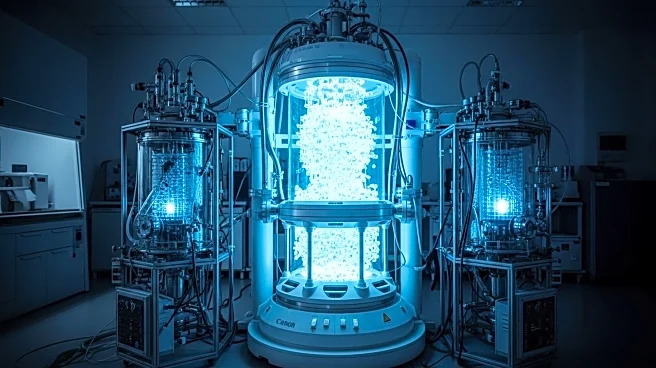

Vaxcyte, Inc. has entered into a $1 billion partnership with Thermo Fisher Scientific to enhance domestic manufacturing for its pneumococcal conjugate vaccines. This deal aims to increase U.S. commercial capacity and strengthen supply chain reliability. Despite a slight decline in shareholder return over the past year, the partnership has generated optimism about Vaxcyte's growth potential. The company's price-to-book ratio of 1.7x suggests undervaluation compared to industry averages.

Why It's Important?

The partnership with Thermo Fisher is a strategic move for Vaxcyte, enhancing its manufacturing capabilities and positioning it for future growth in the biotech sector. The deal reflects the importance of supply chain reliability and domestic production in the pharmaceutical industry. The undervaluation indicated by the price-to-book ratio suggests potential upside for investors, especially if the market recognizes Vaxcyte's growth prospects and pipeline potential.

What's Next?

Vaxcyte may focus on leveraging the partnership to accelerate the development and commercialization of its vaccine pipeline. The company could also explore additional strategic partnerships or investments to enhance its market position. Investors will be watching for updates on Vaxcyte's progress and any potential catalysts that could drive stock performance. The biotech industry will continue to monitor developments in vaccine innovation and manufacturing capabilities.