What's Happening?

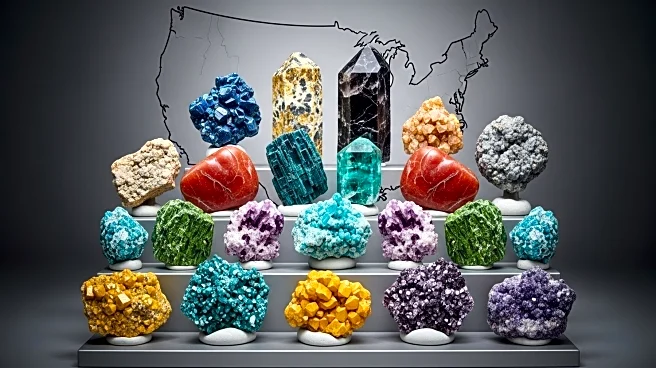

Australian critical minerals companies are expanding their operations in the United States, driven by the country's growing demand for minerals essential to electric vehicles, defense, and advanced manufacturing. Companies like Australian Strategic Materials, Ionic Rare Earths, and International Graphite are exploring opportunities to build processing facilities in the U.S., attracted by the large customer base, cheap energy, and substantial subsidies. ASM is conducting due diligence in Oklahoma and South Carolina, while Ionic Rare Earths is considering Tennessee for its magnet recycling technology.

Why It's Important?

The expansion of Australian critical minerals firms into the U.S. highlights the strategic importance of these resources in supporting the country's technological and defense industries. This move could strengthen the U.S. supply chain for critical minerals, reducing reliance on imports and enhancing national security. The influx of foreign investment may also boost local economies, create jobs, and foster innovation in mineral processing technologies. Additionally, this trend underscores the competitive landscape for securing U.S. funding and incentives in the critical minerals sector.

What's Next?

As these companies finalize their site selections and begin construction, they may face competition for U.S. funding and navigate regulatory challenges. The success of these projects could lead to further collaborations between Australian and U.S. firms, potentially expanding the market for critical minerals. The U.S. government's continued support for domestic mineral processing could influence global supply chains and trade policies, as countries seek to secure their own resources.

Beyond the Headlines

The expansion of critical minerals processing in the U.S. raises questions about environmental impacts and sustainability. As demand for these minerals grows, there may be increased scrutiny on mining practices and their ecological consequences. Additionally, the geopolitical implications of shifting mineral supply chains could affect international relations, particularly with countries like China, which currently dominates the rare earths market.