What's Happening?

Critical Metals Corp has announced a $50 million private investment in public equity (PIPE) transaction to support the development of its Tanbreez rare earth project in Greenland. The financing deal involves

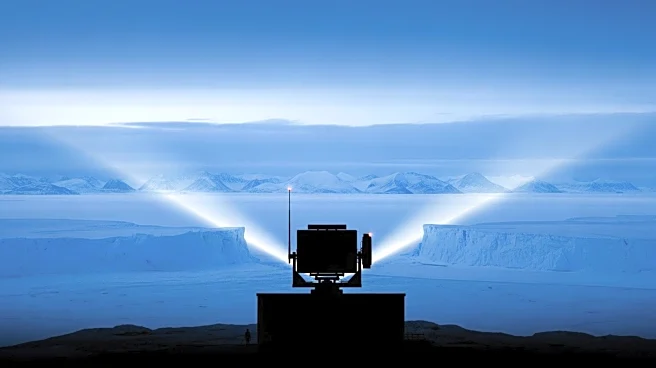

a securities purchase agreement with an institutional investor, which will bolster the company's balance sheet and facilitate the advancement of one of the world's largest rare earth deposits. The Tanbreez project is strategically located with year-round shipping access, making it a key asset in addressing the growing demand for heavy rare earths in Western markets. The company plans to use the proceeds to further develop its critical mineral assets, positioning itself as a reliable supplier of essential materials for electrification and next-generation technologies.

Why It's Important?

The financing is significant as it strengthens Critical Metals Corp's position in the rare earth sector, which is crucial for the clean energy transition and defense applications. Rare earth elements are vital for manufacturing electronics, renewable energy technologies, and military equipment. By advancing the Tanbreez project, Critical Metals Corp aims to become a major supplier of these materials, reducing Western dependence on Chinese rare earth exports. This move could have substantial implications for U.S. industries and national security, as securing a stable supply of rare earths is critical for technological innovation and economic growth.

What's Next?

With the new funding, Critical Metals Corp is expected to accelerate the development of the Tanbreez project, potentially increasing its production capacity and market presence. The company may also seek further partnerships and investments to expand its operations and enhance its supply chain capabilities. As the demand for rare earths continues to rise, Critical Metals Corp's strategic positioning could lead to increased collaboration with governments and private entities aiming to secure critical mineral resources.

Beyond the Headlines

The development of the Tanbreez project could have broader geopolitical implications, as it may shift the balance of power in the global rare earth market. By establishing a reliable supply chain outside of China, Western countries could gain greater control over critical mineral resources, impacting international trade dynamics and strategic alliances. Additionally, the project's success could spur further investment in rare earth mining and processing technologies, driving innovation and sustainability in the sector.