What's Happening?

ABB Group has announced the sale of its ABB Robotics & Discrete Automation division to SoftBank Group Corp. for $5.375 billion. This decision follows ABB's earlier plans to spin off the unit due to declining orders and revenues from 2023 to early 2025. The division, which generated $2.3 billion in revenue in 2024, represents about 7% of ABB's total revenues. ABB Robotics, headquartered in Auburn Hills, Michigan, specializes in industrial automation, robot arms, and autonomous mobile robots. The divestment is expected to create immediate value for ABB shareholders, with proceeds used according to ABB's capital allocation principles. The transaction is anticipated to close in mid-to-late 2026, pending regulatory approvals.

Why It's Important?

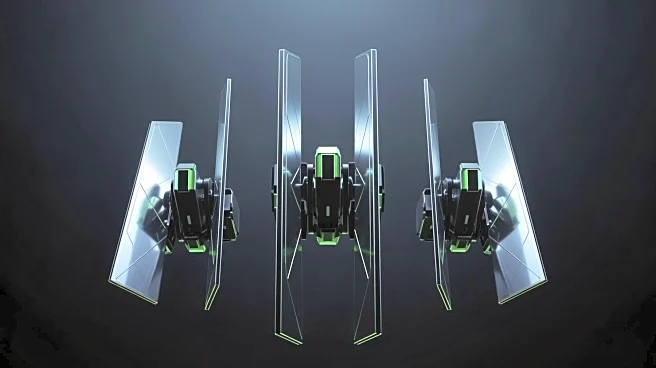

The sale of ABB Robotics to SoftBank marks a significant shift in the robotics and automation industry, potentially enhancing SoftBank's portfolio with advanced robotics technology. This move could influence the competitive landscape, as SoftBank aims to integrate artificial intelligence with robotics, driving innovation in physical AI. For ABB, the divestment allows a strategic refocus on its core areas of electrification and automation, potentially strengthening its market position. The transaction also highlights the growing interest and investment in robotics and AI, which could lead to advancements in various sectors, including manufacturing and logistics.

What's Next?

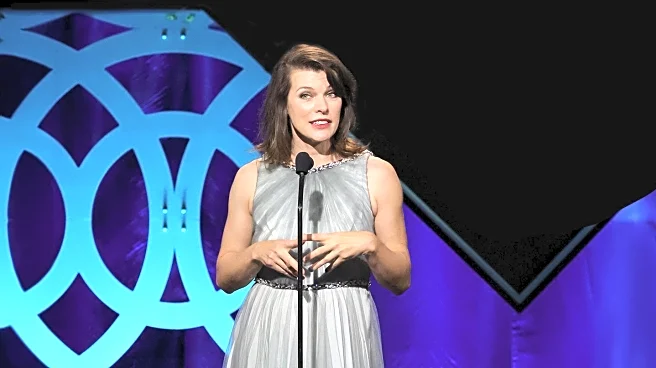

Following the divestment, ABB plans to restructure its business areas, moving its Machine Automation division into Process Automation. This restructuring is expected to occur in the fourth quarter of 2025. ABB will also experience a non-operational pre-tax book gain of approximately $2.4 billion from the sale, with expected cash proceeds of about $5.3 billion. The transaction-related cash tax outflows are estimated between $400 million and $500 million. Additionally, Sami Atiya, president of ABB's Robotics & Discrete Automation business area, will leave the company by the end of 2026, transitioning to a strategic advisor role during the carve-out process.

Beyond the Headlines

The acquisition by SoftBank could lead to long-term shifts in the robotics industry, particularly in the integration of AI and robotics. SoftBank's focus on physical AI suggests potential advancements in autonomous systems and collaborative robots, which could impact industries reliant on automation. The ethical and cultural implications of increased AI integration in robotics may also arise, as society navigates the balance between technological progress and human employment. Furthermore, ABB's strategic refocus might influence its future innovation and investment strategies, potentially affecting its global operations and partnerships.