What's Happening?

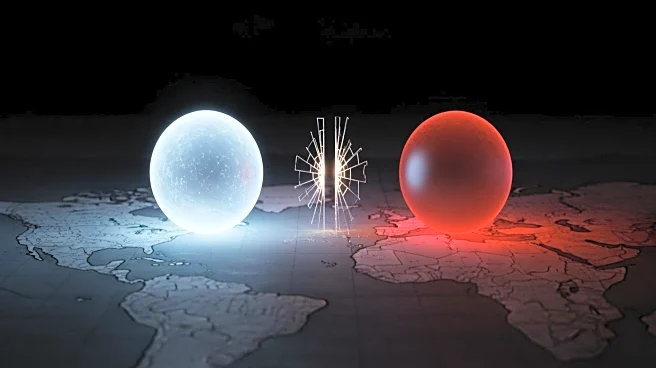

The Trump administration has imposed sweeping sanctions on Russia's largest oil companies, Rosneft and Lukoil, in response to their role in funding the war in Ukraine. The sanctions have led to a significant increase in oil prices, with Brent crude and West

Texas Intermediate crude futures both rising by over 5%. The sanctions are part of a broader effort to cut off financial support for Russia's military activities while encouraging allies to join in the sanctions regime. The move has prompted major buyers of Russian oil, such as China and India, to seek alternative suppliers.

Why It's Important?

The sanctions are a pivotal step in the U.S. strategy to economically pressure Russia and reduce its ability to sustain military operations in Ukraine. By targeting key revenue streams, the sanctions aim to weaken Russia's economic position and force political concessions. The impact on global oil prices underscores the interconnectedness of energy markets and geopolitical events. The sanctions also highlight the challenges of balancing economic measures with the need to maintain stable energy supplies.

What's Next?

The sanctions are set to take effect on November 21, providing a window for companies to adjust their operations. The U.S. may consider additional measures if Russia does not engage in peace talks. The situation could lead to further diplomatic efforts to resolve the conflict, but also risks exacerbating economic tensions. The effectiveness of the sanctions will depend on the ability of the U.S. to enforce them and the response of other countries.