What's Happening?

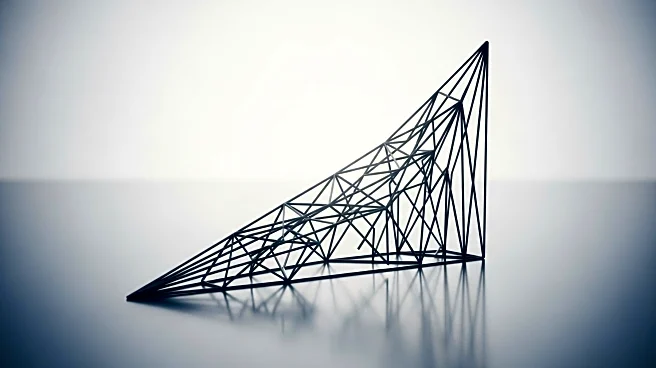

The USD Index has shown a bullish reversal, breaking above a declining resistance line, which has implications for gold, silver, and mining stocks. The reversal in the USD Index has led to a sell signal for these commodities, with the GDXJ index closing below the $100 mark, indicating a potential downturn. The breakdown below a rising wedge pattern suggests possible vertical price drops, especially as miners are currently overbought. This pattern, combined with the USD's resilience despite the U.S. government shutdown, points to potential market shifts.

Why It's Important?

The USD Index's movements are critical for global markets, influencing commodity prices and investor sentiment. A strong USD can lead to lower gold and silver prices, impacting mining stocks and related sectors. The current market dynamics suggest a potential sell-off in precious metals, which could affect investors and companies heavily invested in these commodities. The situation also highlights the USD's role as a safe haven, with its strength potentially triggering broader market corrections.

What's Next?

Market participants will be watching for further developments in the USD Index and its impact on commodities. A continued rally in the USD could lead to significant declines in gold and silver prices, affecting mining stocks. Additionally, economic indicators such as job market data and potential AI-driven job losses could further influence market trends. Investors may need to adjust their strategies in response to these evolving conditions.