What's Happening?

Elland Steel Structures, a Halifax-based company, has reported a significant drop in its pre-tax profit, which has halved due to challenging market conditions. The company's latest accounts for the year

ending June 30, 2025, show a decrease in pre-tax profit from £382,8206 to £192,960. Additionally, the firm's turnover fell by 21% from £22.9 million to £17.9 million, nearly half of its 2023 figure of £35.2 million. Director Mark Denham attributed the decline to a 13% reduction in the UK market for structural steelwork in tonnage, which has also led to a decrease in market rates. The company has seen its cash reserves drop significantly and has bank loans amounting to £247,190. Despite these challenges, Elland Steel expects a 10% increase in turnover over the next year.

Why It's Important?

The financial struggles of Elland Steel highlight broader issues within the UK construction and steel industries, which are facing reduced demand and suppressed prices. The decline in profits and turnover reflects the ongoing challenges in the market, including high costs for labor and energy, and more stringent contract conditions. This situation underscores the vulnerability of the supply chain and the strategic importance of the construction sector, which is often underappreciated for its value addition to the UK economy. The company's investment in automation and skills development is a strategic move to mitigate some of these pressures, indicating a potential path forward for other firms in the sector.

What's Next?

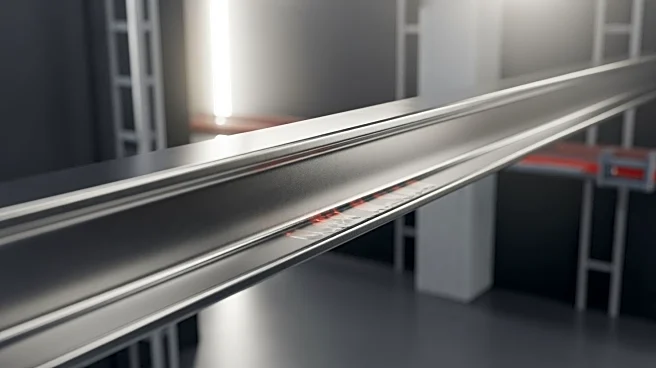

Elland Steel anticipates a slight increase in turnover and profit before tax for the year ending June 30, 2026, as market rates for structural steelwork are expected to rise. The company remains cautious about the next financial year but is more optimistic about the subsequent year. The installation of a Zeman robotic assembly and welding machine is expected to enhance productivity, allowing the company to fabricate and weld up to 70% of its future work. This investment in technology and skills development may help the company navigate the challenging market conditions and improve its financial performance.

Beyond the Headlines

The challenges faced by Elland Steel and similar companies may lead to a reevaluation of the construction sector's strategic importance in the UK. The decline in profits despite volume reductions raises concerns about the robustness of the supply chain. The ongoing investment in automation and skills development could signal a shift towards more sustainable and efficient practices in the industry, potentially leading to long-term benefits despite current difficulties.