What is the story about?

What's Happening?

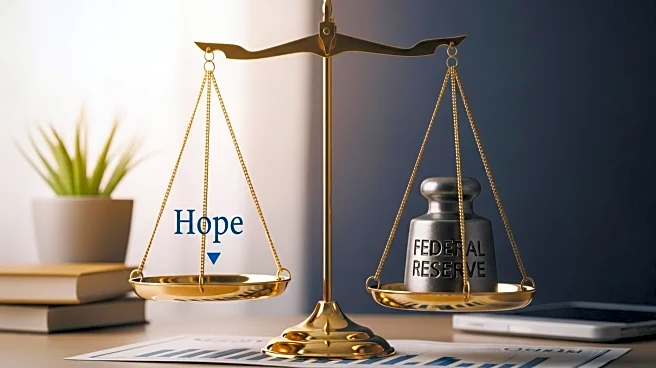

Recent U.S. economic data has led to a rise in Treasury yields and a decline in global equities, as investors worry that the Federal Reserve may become more cautious about further interest rate cuts. The U.S. economy grew at a faster-than-expected rate in the second quarter, with GDP revised upward to a 3.8% annualized rate. Additionally, new orders for key U.S.-manufactured capital goods increased unexpectedly in August. Despite these positive indicators, the labor market remains a concern, with unemployment claims falling more than anticipated. Fed officials, including Chicago Fed President Austan Goolsbee and San Francisco Fed President Mary Daly, have expressed support for the recent rate cut but remain cautious about future reductions.

Why It's Important?

The stronger-than-expected economic data suggests that the U.S. economy may be more resilient than previously thought, potentially reducing the urgency for aggressive monetary easing. This development has significant implications for financial markets, as higher Treasury yields could impact borrowing costs for consumers and businesses. The Fed's cautious stance reflects the ongoing challenge of balancing economic growth with inflation control. Investors are closely monitoring the Fed's actions and economic indicators to gauge the future direction of monetary policy. The bond market's reaction to the data highlights the complexities of predicting interest rate movements and their impact on the broader economy.

What's Next?

The Federal Reserve's next steps will likely depend on upcoming economic data, including the Personal Consumption Expenditures index, which is a key measure of inflation. Market participants will be watching for any signs that could influence the Fed's decision-making process. The potential for a government shutdown adds another layer of uncertainty, as it could disrupt economic data releases and complicate the Fed's assessment of the economic landscape. Investors will need to remain vigilant and adaptable as they navigate the evolving economic environment and its implications for monetary policy and market dynamics.