What's Happening?

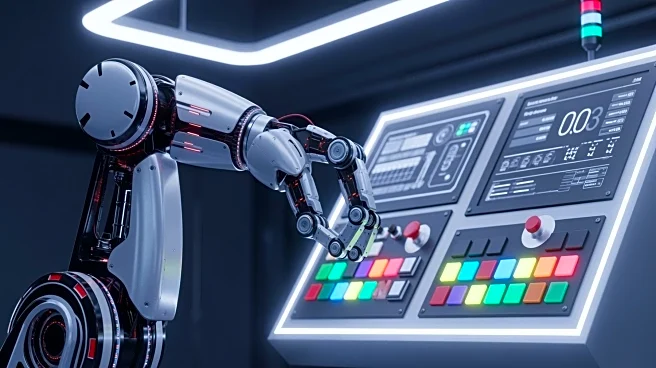

Elon Musk, CEO of Tesla, has expressed his desire to maintain control over Tesla's growing robot workforce, particularly the Optimus humanoid robots. During Tesla's recent earnings conference, Musk highlighted

the company's ambitions beyond electric vehicles, focusing on robotics and artificial intelligence. He also discussed a potential $1 trillion pay package contingent on Tesla meeting ambitious targets, including delivering 20 million cars and launching one million robotaxis. Musk voiced concerns about the influence of shareholder advisory firms ISS and Glass Lewis, which he referred to as 'corporate terrorists,' fearing their recommendations could undermine his control over Tesla.

Why It's Important?

Musk's vision for Tesla extends beyond automotive manufacturing, positioning the company as a leader in robotics and AI. This shift could significantly impact the tech and automotive industries, potentially redefining market dynamics. The ambitious targets set by Musk, if achieved, could elevate Tesla's market value and influence. However, the involvement of advisory firms like ISS and Glass Lewis introduces uncertainty, as their recommendations could sway institutional investors, affecting corporate governance and Musk's strategic plans. The outcome of this situation could influence investor confidence and Tesla's future trajectory.

What's Next?

Tesla shareholders are expected to vote on the proposed pay package for Musk, which could solidify his control if approved. The company's ability to meet its ambitious targets will be closely monitored by investors and industry analysts. The response from ISS and Glass Lewis, as well as their influence on institutional investors, will be pivotal in shaping Tesla's governance and strategic direction. The broader tech and automotive sectors will be watching closely, as Tesla's success or failure in these endeavors could set precedents for innovation and corporate governance.