What's Happening?

Opinicus Capital Inc. has increased its holdings in Taiwan Semiconductor Manufacturing Company Ltd. (TSM) by 10.3% during the second quarter, as per its latest filing with the Securities and Exchange Commission. The institutional investor now owns 18,357

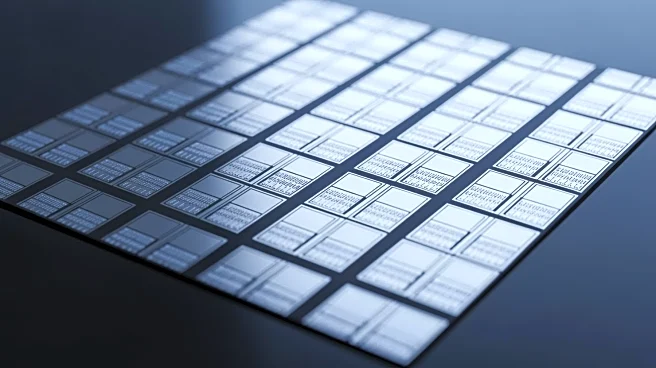

shares of TSM, making it the sixth largest position in its portfolio, valued at $4,158,000. Other investors such as Foundations Investment Advisors LLC and CFO4Life Group LLC have also modified their holdings in TSM, indicating a growing interest in the semiconductor company. Analysts have issued various ratings for TSM, with Citigroup maintaining a 'buy' rating and Susquehanna raising its price objective for the company. TSM's stock performance has been strong, with a market cap of $1.48 trillion and a recent quarterly earnings report showing a significant increase in revenue.

Why It's Important?

The increased investment in Taiwan Semiconductor Manufacturing Company Ltd. by Opinicus Capital Inc. and other institutional investors highlights the company's strong position in the semiconductor industry. TSM's robust financial performance and positive analyst ratings suggest confidence in its future growth prospects. This development is significant for the U.S. technology sector, as TSM plays a crucial role in the global supply chain for semiconductors, which are essential components in various tech products. The company's expansion and increased institutional interest may lead to further advancements in semiconductor technology, impacting industries such as consumer electronics, automotive, and telecommunications.

What's Next?

With TSM's continued growth and positive analyst ratings, the company is likely to maintain its strong market position. The increased holdings by institutional investors may lead to further investments and partnerships, potentially driving innovation in semiconductor technology. Analysts forecast continued earnings growth for TSM, which could result in higher stock valuations and increased dividends for shareholders. The company's strategic decisions and market performance will be closely watched by investors and industry stakeholders, as they could influence trends in the semiconductor market and related industries.