What's Happening?

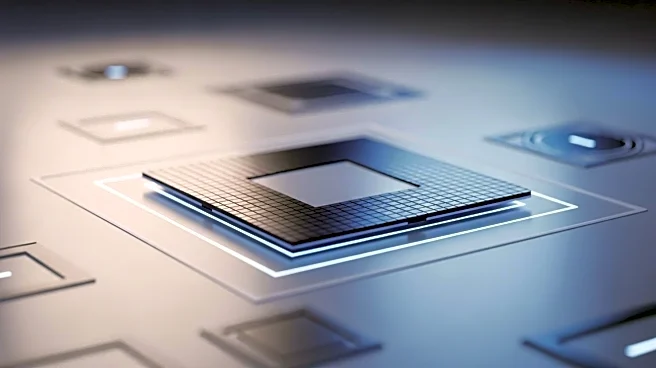

SRN Advisors LLC has decreased its holdings in Taiwan Semiconductor Manufacturing Company Ltd. (NYSE:TSM) by 27.4% during the first quarter, as reported in its latest filing with the Securities & Exchange Commission. The institutional investor sold 1,662 shares, reducing its stake to 4,405 shares valued at $731,000. Other hedge funds have also adjusted their positions in TSM, with City Holding Co. increasing its holdings by 238% and Accredited Wealth Management LLC acquiring new stakes. Taiwan Semiconductor Manufacturing's stock is currently owned 16.51% by institutional investors and hedge funds. The company reported strong earnings results for the quarter ending July 17th, with a net margin of 42.91% and a return on equity of 33.37%.

Why It's Important?

The reduction in holdings by SRN Advisors LLC and other institutional investors reflects strategic adjustments in their investment portfolios, potentially influenced by market conditions or company performance. Taiwan Semiconductor Manufacturing is a key player in the semiconductor industry, and changes in institutional holdings can impact stock prices and investor sentiment. The company's strong financial performance, including a 44.4% increase in revenue year-over-year, highlights its robust market position. Analysts have given TSM a consensus 'Buy' rating, indicating confidence in its future growth prospects, which could influence investment decisions and market dynamics.

What's Next?

Taiwan Semiconductor Manufacturing has announced an increase in its quarterly dividend, which will be paid on January 8th, 2025. This move may attract more investors seeking dividend income. Analysts have set new price targets for TSM shares, with Citigroup and Needham & Company LLC maintaining 'Buy' ratings and projecting growth. The company's guidance for Q3 2025 suggests continued strong performance, which could further bolster investor confidence. As institutional investors adjust their holdings, market observers will watch for potential impacts on TSM's stock price and overall market trends.