What's Happening?

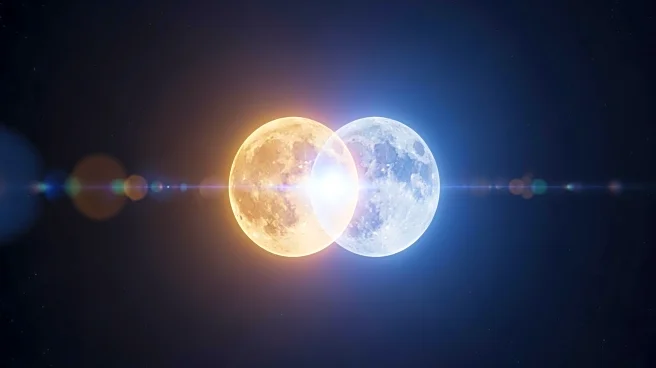

Gold prices have reached an all-time high of $3,660 per ounce, breaking through key resistance levels that had kept the price in a sideways trend since April 2025. This surge represents a 45% increase year-over-year and a 90% rise over the past two years. Silver prices have also increased significantly, reaching $41.35 per ounce, marking a 45% increase year-over-year and an 80% gain over the last two years. The rapid price increases are attributed to economic factors such as central bank interest rate cuts, international economic tensions, and doubts about government creditworthiness, which have driven demand for gold and silver as safe havens.

Why It's Important?

The rise in gold and silver prices reflects broader economic uncertainties and investor concerns about the reliability of fiat money. As governments face challenges in meeting debt obligations, investors are increasingly turning to precious metals as a hedge against inflation and economic instability. This trend highlights the role of gold and silver as stores of value, protecting against the loss of purchasing power in fiat currencies. The current economic environment suggests that these metals will continue to be attractive to investors seeking to safeguard their wealth.

What's Next?

The steep upward trend in gold and silver prices may flatten out after reaching higher levels, with growth rates normalizing to align with historical averages. However, significant price increases are still expected, with gold potentially reaching $4,000 per ounce and silver hitting $48 per ounce. The ongoing economic challenges, particularly in the euro area, could lead to further increases in precious metal prices as investors seek protection against financial instability.

Beyond the Headlines

The current surge in gold and silver prices may represent a permanent adjustment rather than a temporary exaggeration. This shift reflects a new valuation regime driven by increased investment risk and the need for insurance against economic downturns. As governments and banks face growing challenges, the demand for gold and silver as 'near-monies' is likely to persist, reinforcing their role as safe havens in times of economic stress.