What's Happening?

Crossmark Global Holdings Inc. has increased its holdings in Taiwan Semiconductor Manufacturing Company Ltd. (TSM) by 3.2% during the second quarter, according to its latest SEC filing. The firm now owns

322,424 shares, valued at $73,026,000, making TSM its 7th largest holding. Other institutional investors have also adjusted their positions, with Powers Advisory Group LLC purchasing a new position valued at $240,000 and Hudson Edge Investment Partners Inc. increasing its stake by 10.1%.

Why It's Important?

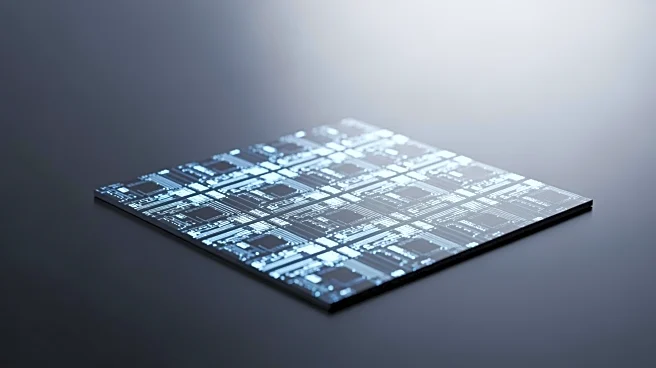

The expansion of holdings by Crossmark Global Holdings Inc. and other institutional investors reflects confidence in Taiwan Semiconductor Manufacturing's market position and growth potential. TSM's strong financial performance, including a significant revenue increase, underscores its importance in the semiconductor industry, which is vital for technological advancements. The company's strategic focus on AI and advanced technologies positions it well for continued growth, impacting the broader tech sector and global economic trends.

What's Next?

Taiwan Semiconductor Manufacturing has set its Q4 2025 guidance at EPS, indicating a focus on maintaining strong financial performance. Analysts have issued various ratings, with a consensus price target of $371.67, suggesting potential for stock appreciation. The company's strategic expansions and focus on advanced technologies will be closely monitored by investors and analysts, assessing future growth opportunities and market conditions.

Beyond the Headlines

The semiconductor industry plays a crucial role in driving technological innovation, impacting sectors such as consumer electronics, automotive, and telecommunications. TSM's advancements in wafer fabrication processes and strategic global expansions highlight its influence in shaping the future of technology. The company's commitment to innovation and growth underscores the significance of semiconductors in the global economy, influencing technological trends and economic policies.