What's Happening?

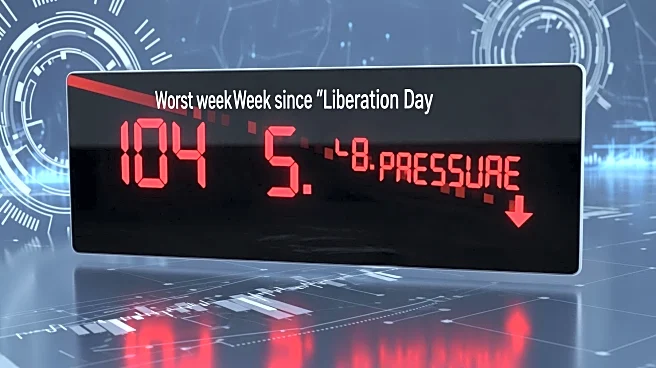

The Nasdaq Composite Index is experiencing its most challenging week since 'Liberation Day' due to significant pressure on the technology sector. This downturn is largely attributed to disappointing earnings

reports and ongoing US-China trade tensions. Notably, Take-Two Interactive's shares fell by 8% following the announcement of another delay in the release of 'Grand Theft Auto VI,' overshadowing the company's strong earnings and improved outlook. Additionally, Block's shares dropped nearly 8% after missing third-quarter sales and profit forecasts, despite growth in its Cash App platform. Tesla's stock also declined by close to 4% after shareholders approved a substantial pay package for CEO Elon Musk, potentially worth $1 trillion if certain performance goals are met.

Why It's Important?

The current downturn in the Nasdaq highlights the vulnerability of the tech sector to both internal and external pressures. The delay in major product releases, such as 'Grand Theft Auto VI,' can significantly impact investor confidence and stock performance. Furthermore, the approval of Elon Musk's pay package at Tesla underscores the ongoing debate over executive compensation, especially in high-stakes tech companies. These developments could influence investor strategies and market dynamics, potentially leading to increased scrutiny of tech companies' financial health and strategic decisions. The broader implications for the U.S. economy include potential shifts in investment patterns and a reevaluation of tech sector valuations.

What's Next?

Investors and analysts will likely monitor upcoming earnings reports and any further developments in US-China trade relations, as these factors could continue to influence market performance. Companies like Take-Two Interactive and Block may face pressure to deliver on their revised forecasts to regain investor confidence. Additionally, the tech sector's response to these challenges could set precedents for future corporate governance and compensation practices. Stakeholders will also be watching for any policy changes or regulatory actions that could impact the tech industry.