What's Happening?

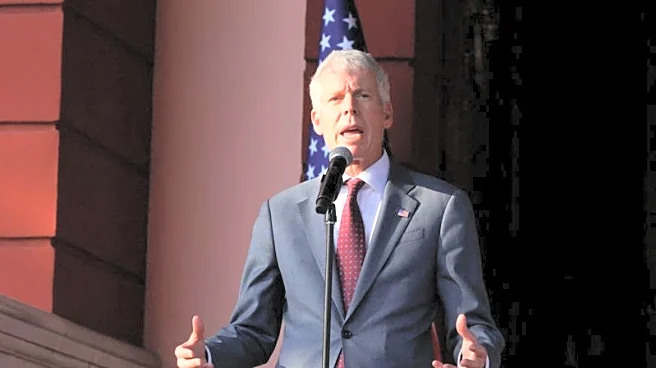

The Federal Reserve, led by Chair Jerome Powell, has cut interest rates for the first time this year, amidst rising inflation and a weakening labor market. Powell acknowledged the complexity of the situation, stating that the Fed's tools cannot simultaneously address both inflation and employment issues. The rate cut aims to bring interest rates to a neutral level, balancing economic growth without accelerating inflation. The Fed's decision reflects the challenges of managing economic stability in the face of conflicting indicators.

Why It's Important?

This development underscores the Fed's struggle to navigate economic policy amid mixed signals. The rate cut is intended to stimulate growth, but it also risks increasing inflation if not managed carefully. The Fed's actions are crucial for maintaining economic stability, influencing sectors such as housing, consumer spending, and investment. The decision highlights the delicate balance required to support the economy without triggering inflationary pressures, which could have significant implications for future policy decisions.

What's Next?

The Fed will continue to monitor economic indicators to determine the pace of future rate adjustments. Stakeholders, including businesses and policymakers, will be closely observing the Fed's actions to gauge potential impacts on economic growth and inflation. The Fed's approach may influence market expectations and investor confidence, affecting broader economic trends.