What's Happening?

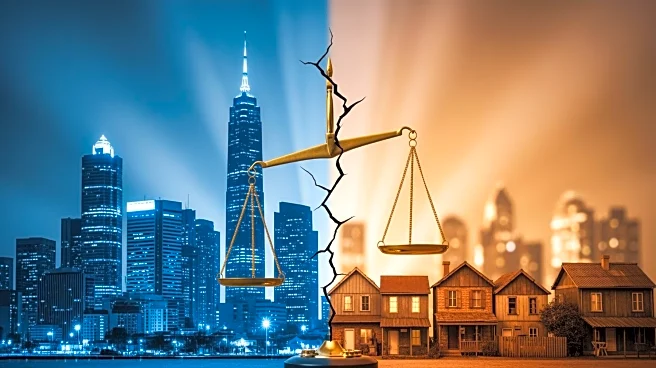

The Mediterranean Shipping Company (MSC) has been mandated by the Italian Competition Authority to divest its investment in Moby, a ferry operator servicing routes between Italy and Mediterranean islands. This decision follows an investigation into the market

concentration of ferry services, which are predominantly operated by Moby and Grandi Navi Veloci (GNV), both linked to MSC. The authority's ruling requires MSC to transfer its 49% stake in Moby back to the Onorato family, the previous owners, and relinquish rights to acquire the remaining shares. Additionally, MSC must compensate consumers who purchased tickets on Moby ferries. Moby, facing financial challenges, will undergo restructuring, including asset sales to repay loans provided by MSC.

Why It's Important?

This divestiture represents a significant regulatory intervention aimed at maintaining competitive balance in the ferry service market. The decision underscores the importance of antitrust regulations in preventing market monopolies that could lead to higher prices and reduced service quality for consumers. For MSC, this ruling is a setback in its expansion strategy, which has seen the company grow into the largest container carrier globally. The outcome also benefits competitors like the Grimaldi group, which had challenged MSC's investment in Moby. The ruling highlights the ongoing scrutiny of large corporate mergers and acquisitions by regulatory bodies to ensure fair competition.

What's Next?

Moby will focus on financial restructuring to stabilize its operations, including selling non-strategic assets and entering charter-back agreements. The company aims to reduce its debt and enhance service quality, particularly on routes to Sardinia. For MSC, the divestiture may prompt a reassessment of its investment strategies in the ferry sector. The decision could also influence future regulatory actions in the maritime industry, as authorities continue to monitor market dynamics and enforce competition laws. Stakeholders will be watching closely to see how Moby navigates its financial challenges and whether MSC will pursue other growth opportunities.

Beyond the Headlines

The divestiture highlights broader issues of market concentration and the role of regulatory bodies in maintaining competitive markets. It raises questions about the balance between corporate growth and market fairness, particularly in industries with high entry barriers. The case also illustrates the complexities of international business operations, where companies must navigate varying regulatory environments. In the long term, this ruling could influence corporate strategies, encouraging companies to consider potential regulatory challenges when planning mergers and acquisitions.