What's Happening?

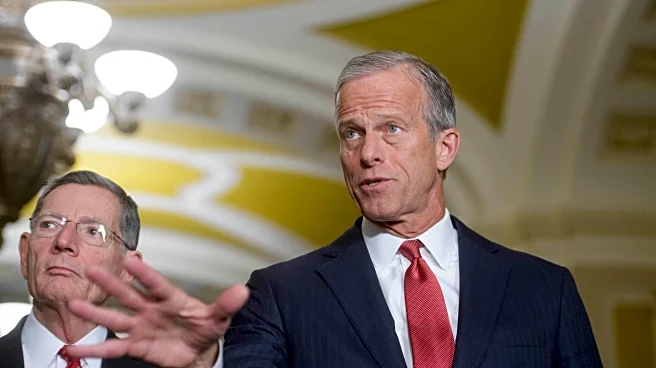

Treasury Secretary Scott Bessent has expressed optimism that a meeting between President Trump and Chinese President Xi Jinping will proceed as planned, despite recent tensions over China's decision to tighten exports of rare earths. Bessent, speaking on Fox Business, indicated that substantial communication had occurred over the weekend following Beijing's lack of response to U.S. inquiries regarding the rare earths policy change. The meeting is expected to take place in Korea, and Bessent emphasized that all options remain open for potential retaliatory measures against China's export restrictions.

Why It's Important?

The potential meeting between President Trump and President Xi Jinping is significant as it could influence the ongoing trade relations between the U.S. and China, particularly in light of China's recent policy on rare earth exports. Rare earths are critical components in various industries, including technology and defense, and China's export restrictions could impact global supply chains. The U.S. may consider retaliatory actions, which could further escalate trade tensions. The meeting could serve as a platform for negotiation and resolution, affecting economic stakeholders and international trade dynamics.

What's Next?

If the meeting proceeds, it could lead to discussions aimed at resolving the rare earth export issue and potentially easing trade tensions between the U.S. and China. Stakeholders in industries reliant on rare earths will be closely monitoring the outcome, as any agreements or retaliatory measures could have significant implications for supply chains and market stability. Political leaders and businesses may react based on the meeting's results, influencing future trade policies and international relations.

Beyond the Headlines

The rare earth export issue highlights the strategic importance of these materials in global trade and national security. China's control over a significant portion of the world's rare earth supply underscores the geopolitical leverage it holds. The situation may prompt the U.S. to explore alternative sources or invest in domestic production capabilities to reduce dependency on Chinese exports, potentially leading to long-term shifts in trade and industry practices.