What is the story about?

What's Happening?

Iran is facing a severe currency crisis as the value of the rial plummets against the U.S. dollar on the black market. The exchange rate has reached a historic high of approximately 1.08 million rials per dollar, driven by fears of reinstated nuclear sanctions following the end of UN 'snapback' waivers. The official rate remains significantly lower, highlighting the disparity between state-backed and black-market rates. Political tensions within Iran, including Supreme Leader Khamenei's rejection of U.S. talks and President Pezeshkian's lobbying at the UN, contribute to the uncertainty. Inflation rates in Iran are around 35-40%, exacerbating public discontent over living costs.

Why It's Important?

The crisis in Iran's currency market has significant implications for the country's economy and its ability to engage in international trade. The reactivation of sanctions is expected to throttle Iran's oil revenue and financial flows, tightening the supply of hard currency. This situation could lead to increased economic strain and social unrest as inflation continues to rise. The strong U.S. dollar, bolstered by robust economic data and geopolitical tensions, further complicates Iran's financial challenges. The disparity between official and black-market rates reflects the broader economic instability and the impact of external pressures on Iran's domestic policy.

What's Next?

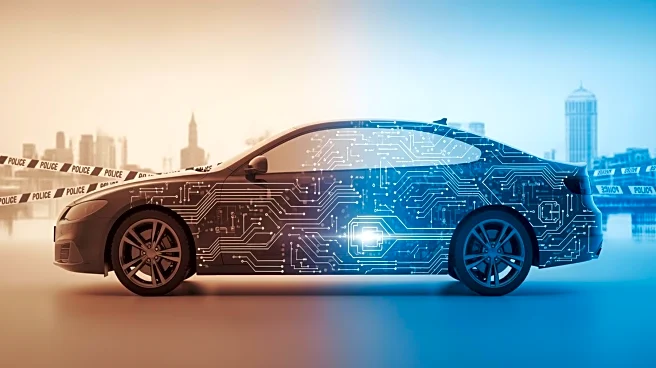

Iran is exploring financial reforms, including a plan to cut four zeros off the rial and the rollout of a digital currency (CBDC) to modernize banking and bypass sanctions. The government is also implementing measures to stabilize the currency, such as import bans and pumping dollars into the market. However, without significant changes in international relations or economic policy, the rial's decline is likely to continue. The Supreme Court's upcoming decision on sanctions could further influence Iran's economic trajectory.

Beyond the Headlines

The currency crisis in Iran highlights the complex interplay between domestic policy and international sanctions. The government's efforts to implement digital currency and financial reforms reflect a strategic shift towards modernizing the economy and reducing reliance on traditional currency systems. The situation also underscores the broader geopolitical tensions in the Middle East, with the U.S. dollar serving as a safe-haven asset amid regional conflicts.