What is the story about?

What's Happening?

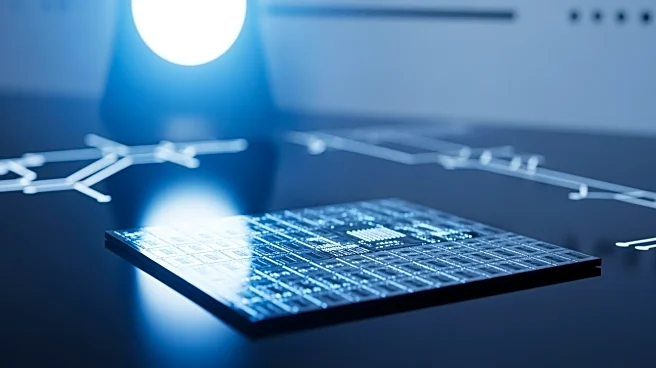

President Donald Trump has accused China of becoming hostile after Beijing imposed sweeping export controls on rare earth minerals. These minerals are crucial for the production of electronics, automobiles, and semiconductors. In response, Trump announced plans to restore tariffs on Chinese goods to triple-digit levels, prompting China to vow corresponding measures. This escalation has rattled global markets and raised fears of a repeat of previous trade conflicts. The tensions threaten to derail progress made in trade negotiations and cast doubt on a planned meeting between President Trump and Chinese leader Xi Jinping. The U.S. expanded its export restrictions in late September, increasing the number of Chinese entities on its control list, which Beijing claims provoked its recent actions.

Why It's Important?

The renewed trade tensions between the U.S. and China have significant implications for global industries reliant on rare earth minerals. These minerals are essential for manufacturing in sectors such as technology and defense. The escalation could disrupt supply chains and lead to shortages, affecting production and innovation. The U.S. and China are the world's largest economies, and their trade policies influence global economic stability. The situation also impacts diplomatic relations, as both countries navigate complex negotiations. Industries and governments worldwide are closely monitoring the developments, as prolonged tensions could lead to increased costs and economic uncertainty.

What's Next?

The planned meeting between President Trump and Xi Jinping in South Korea is uncertain, with both sides expressing willingness to continue talks but under strained conditions. The U.S. Treasury Secretary expects the meeting to proceed, but the outcome remains unclear. China has signaled readiness to retaliate if the U.S. imposes further tariffs. The global community is watching for potential resolutions or further escalations, which could impact international trade agreements and economic policies. Stakeholders in affected industries may seek alternative sources for rare earth minerals to mitigate risks associated with the trade conflict.

Beyond the Headlines

China's control over rare earth minerals highlights its strategic leverage in global trade. The U.S. dependence on these resources underscores vulnerabilities in its supply chain. The situation reflects broader geopolitical dynamics, where economic measures are used as tools of influence. The trade tensions may prompt countries to reassess their reliance on foreign resources and explore domestic alternatives. The conflict also raises ethical questions about the use of trade policies to exert pressure and the long-term impact on international relations.