What's Happening?

GE Aerospace has experienced a significant increase in its stock value, with shares closing at approximately $304 on October 24, marking an 82% rise year-to-date. The stock briefly reached a record high

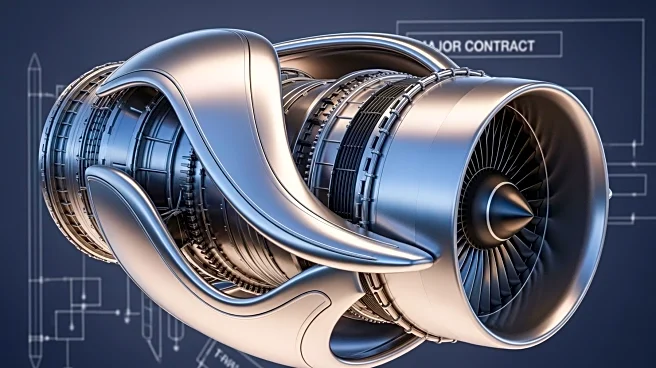

of around $316 on October 21. This surge is attributed to GE's strong third-quarter earnings, which exceeded expectations with an adjusted EPS of $1.66 and revenue of $12.2 billion. The company has raised its profit outlook for 2025, projecting adjusted EPS between $6.00 and $6.20. GE Aerospace has secured major contracts, including a multi-year deal with the U.S. Air Force worth up to $5 billion for fighter-jet engines and a seven-year service agreement with AerCap for GE9X engines. Additionally, the U.S. Commerce Department lifted export restrictions on GE's engines for China's COMAC jets, enhancing GE's market potential in China.

Why It's Important?

The rise in GE Aerospace's stock reflects strong investor confidence and highlights the company's strategic positioning in the aerospace industry. The lifting of export restrictions by the U.S. government is a significant development, potentially increasing GE's market share in China, a crucial market for aerospace products. The contracts with the U.S. Air Force and AerCap ensure a steady revenue stream, bolstering GE's defense and commercial sectors. This growth is indicative of a broader recovery in the aerospace industry, driven by increased demand for aircraft engines and maintenance services as global air travel rebounds. The positive outlook and strategic wins position GE Aerospace as a key player in the industry, with implications for U.S. economic growth and employment in the sector.

What's Next?

GE Aerospace is expected to continue capitalizing on the growing demand for aircraft engines and services. The company's raised profit outlook suggests optimism about future earnings, driven by ongoing contracts and potential new deals. Analysts have increased their price targets for GE, with UBS setting a target of $366, indicating strong market confidence. The resolution of labor strikes and government support further remove production hurdles, allowing GE to focus on expanding its operations. Investors and industry stakeholders will be closely monitoring GE's performance in the upcoming quarters, particularly in light of geopolitical tensions and economic uncertainties that could impact global travel demand.

Beyond the Headlines

The developments at GE Aerospace underscore the importance of government policy in shaping industry dynamics. The lifting of export restrictions not only benefits GE but also reflects broader trade relations between the U.S. and China. The aerospace sector's recovery is a positive indicator for the U.S. economy, potentially leading to job creation and technological advancements. However, rising costs due to tariffs and commodity prices pose challenges that GE must navigate. The company's focus on next-generation technologies, such as hybrid-electric engines, highlights a commitment to innovation and sustainability, which could have long-term implications for the industry.