What's Happening?

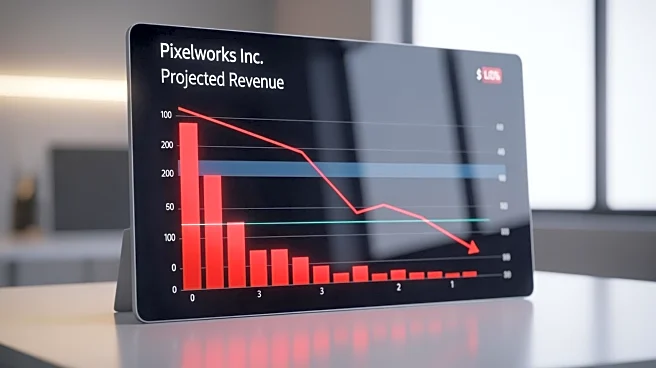

Pixelworks Inc, a Portland, Oregon-based company, is expected to report a decrease in quarterly revenue and a loss per share for the period ending September 30, 2025. The company anticipates a 5.5% drop

in revenue to $9 million, down from $9.53 million a year ago, according to an analyst's estimate based on LSEG data. The guidance provided by Pixelworks on August 12, 2025, projected revenue between $8.50 million and $9.50 million. Additionally, the mean analyst estimate for the company's earnings per share (EPS) is a loss of 86 cents, with guidance ranging from $-1.02 to $-0.70. Despite the anticipated financial challenges, the sole analyst rating on Pixelworks shares remains a 'buy'. The company's gross profit margin guidance for the period was between 47% and 49%.

Why It's Important?

The expected financial results for Pixelworks Inc highlight potential challenges in the semiconductor industry, particularly for smaller companies facing revenue declines and losses. This situation may impact investor confidence and influence stock performance, as indicated by the median 12-month price target of $15.00, which is significantly higher than the last closing price of $6.28. The company's ability to navigate these financial hurdles could affect its strategic decisions, including potential cost-cutting measures or shifts in business focus. The broader implications for the industry include potential shifts in market dynamics, as companies like Pixelworks adjust to changing demand and technological advancements.

What's Next?

Pixelworks Inc is scheduled to report its financial results on November 11, 2025. The company's performance will be closely monitored by investors and analysts, who will assess its ability to meet or exceed the projected figures. The results may prompt further analysis of the company's strategic direction, including potential partnerships, product innovations, or market expansions. Stakeholders will be keen to understand how Pixelworks plans to address the anticipated revenue decline and loss, and whether it can leverage its technological capabilities to improve future performance.