What's Happening?

CPI Aerostructures has reported an increase in net income for the third quarter of 2025, driven by an improved product mix and operational efficiencies. The company's revenue for Q3 was slightly down at $19.3 million, but net income rose to $1.1 million from

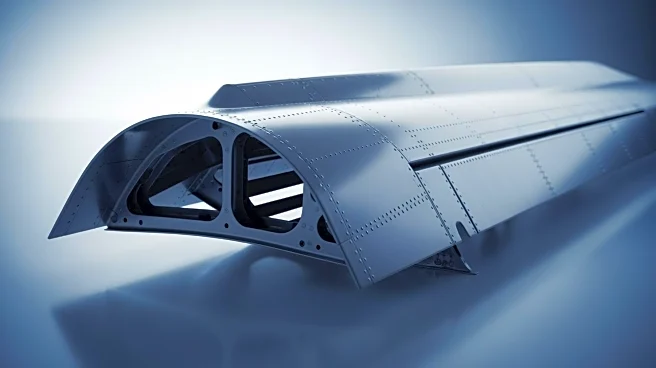

$0.7 million the previous year. The gross margin improved to 22.3%, reflecting a 60 basis points increase. The company also secured a contract from Raytheon for missile wing assemblies, adding to its backlog and strategic positioning.

Why It's Important?

The financial performance of CPI Aerostructures highlights the impact of strategic product mix improvements and operational efficiencies on profitability. The increase in net income and gross margin indicates effective management and adaptation to market conditions. The Raytheon contract represents a significant strategic win, enhancing the company's backlog and future revenue prospects. This development is important for stakeholders in the aerospace industry, as it demonstrates the potential for growth through strategic partnerships and product diversification.

What's Next?

CPI Aerostructures is expected to focus on leveraging its improved product mix and operational efficiencies to sustain profitability and growth. The Raytheon contract will likely contribute to future revenue streams, positioning the company for continued success in the aerospace sector. Stakeholders will be monitoring the company's ability to capitalize on its strategic wins and maintain its competitive edge. Future developments may include further contract acquisitions and expansion of product offerings to enhance market presence.