What is the story about?

What's Happening?

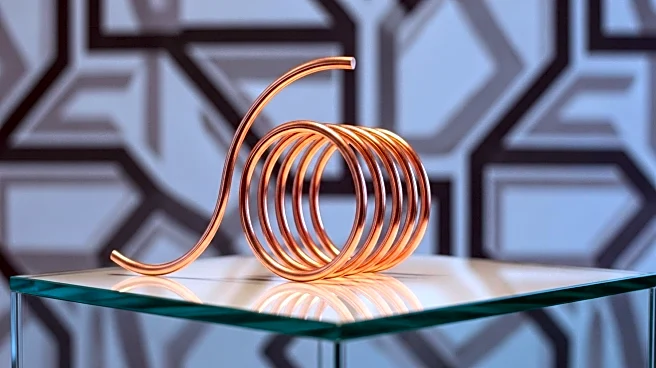

Copper futures have stabilized after a sharp decline, with prices supported by a weekly cloud model near $4.60 per pound. Indicators such as weekly stochastics and MACD histogram suggest improving momentum for copper. Southern Copper (SCCO) has benefited from this stabilization, reversing a cyclical downtrend with a breakout above the weekly cloud model. This breakout is associated with increased momentum, supporting potential upside towards resistance near $130. The long-term momentum for SCCO is also improving, with the monthly MACD nearing a 'buy' signal.

Why It's Important?

The stabilization of copper prices and the subsequent market performance of Southern Copper highlight the interconnectedness of commodity prices and mining stocks. As copper prices find their footing, mining companies like Southern Copper stand to benefit from improved market conditions. This development is significant for investors seeking exposure to the mining sector, as it suggests potential for growth and profitability. The improving momentum indicators for Southern Copper also indicate a positive outlook for the company's market performance.

What's Next?

Investors and market analysts will likely continue to monitor copper prices and Southern Copper's market performance closely. The potential for further price increases could drive additional investment in the mining sector. Southern Copper's ability to clear final resistance levels and achieve long-term growth targets will be a key focus for stakeholders. The broader implications for the mining industry and commodity markets will also be considered, as changes in copper prices can impact global supply chains and economic conditions.

Beyond the Headlines

The stabilization of copper prices and Southern Copper's market performance may prompt a reevaluation of investment strategies in the mining sector. The potential for long-term growth and profitability could attract new investors and drive increased interest in mining stocks. This situation also highlights the importance of technical analysis and momentum indicators in assessing market trends and investment opportunities.