What's Happening?

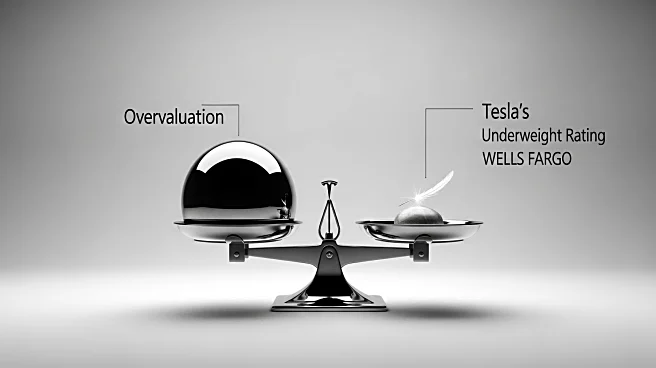

Wells Fargo has reiterated its position on Tesla, maintaining an 'underweight' rating due to concerns over the stock's valuation. The financial institution believes that Tesla shares are currently overvalued, with too much hype factored into the stock price. This assessment comes amidst a series of analyst calls on Wall Street, where various firms have issued ratings and price targets for major companies. Wells Fargo's stance on Tesla reflects a cautious approach, suggesting that the market may be overly optimistic about the company's future prospects. Other notable calls include Morgan Stanley's continued 'overweight' rating for Nvidia, citing positive short- and long-term outlooks, and HSBC's upgrade of Synchrony to 'buy' from 'hold', highlighting compelling share levels.

Why It's Important?

The reiteration of Tesla as 'underweight' by Wells Fargo is significant as it highlights ongoing concerns about the stock's valuation amidst a broader market environment where tech stocks have seen substantial growth. Tesla, a major player in the electric vehicle market, has been a focal point for investors due to its innovative approach and market leadership. However, Wells Fargo's caution suggests potential risks for investors who may be banking on continued rapid growth. This could influence investment strategies and market sentiment, particularly for those heavily invested in tech stocks. The broader implications of these analyst calls reflect the dynamic nature of the stock market, where valuations and growth prospects are constantly reassessed.

What's Next?

The market may see adjustments in investor strategies as they respond to Wells Fargo's assessment of Tesla and other analyst calls. Investors might reconsider their positions in Tesla, potentially leading to shifts in stock prices. Additionally, the broader tech sector could experience volatility as firms like Nvidia and AMD continue to receive positive ratings, influencing investor confidence. Stakeholders will likely monitor these developments closely, assessing the impact of these ratings on their portfolios and the market at large. The ongoing analysis and updates from financial institutions will play a crucial role in shaping market dynamics in the coming months.

Beyond the Headlines

The reiteration of Tesla as 'underweight' by Wells Fargo may also prompt discussions about the sustainability of tech stock valuations. As companies like Tesla continue to innovate, questions about the balance between hype and actual performance could arise. This situation underscores the importance of critical analysis in investment decisions, where understanding the underlying factors driving stock prices is crucial. The broader conversation may also touch on the role of financial institutions in guiding investor sentiment and the ethical considerations of their influence on market perceptions.