What's Happening?

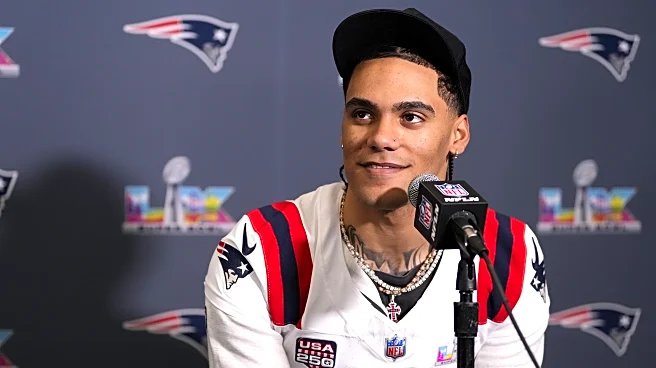

Ari Lauer, a California attorney, has pleaded guilty to charges related to his involvement in a $912 million Ponzi scheme orchestrated by DC Solar, a solar power supply company. The plea was entered before

U.S. District Judge Dale Drozd in Sacramento, covering 23 counts including bank fraud and wire fraud affecting a financial institution. The scheme involved DC Solar entering contracts to sell solar generators, but the company only possessed about half of the 17,000 generators it promised, leading to fraudulent activities to cover the shortfall. Lauer's sentencing is scheduled for January 26th, following the conviction of DC Solar's owners, Paulette and Jeff Carpoff, who received significant prison sentences.

Why It's Important?

This case highlights the vulnerabilities in the renewable energy sector, where fraudulent activities can undermine trust and investment. The significant financial impact of the scheme, with $790 million ordered to be repaid by Jeff Carpoff, underscores the potential for large-scale financial fraud in emerging industries. The legal repercussions for Lauer, including the potential loss of his law license, serve as a cautionary tale for legal professionals involved in corporate governance and compliance. The case may prompt increased scrutiny and regulatory measures in the solar industry to prevent similar fraudulent schemes.

What's Next?

Lauer's sentencing in January will determine the extent of his legal penalties, which could include substantial prison time and financial restitution. The case may lead to further investigations into DC Solar's operations and other potential fraudulent activities within the company. Regulatory bodies might consider implementing stricter oversight and compliance requirements for solar companies to safeguard against future fraud. Legal professionals and corporate entities may also reassess their internal controls and ethical standards to prevent involvement in fraudulent schemes.

Beyond the Headlines

The ethical implications of this case extend beyond the legal penalties, raising questions about corporate responsibility and the role of legal advisors in preventing fraud. The long-term impact on the solar industry could include a shift towards more transparent business practices and increased investor skepticism. This case may also influence public perception of renewable energy companies, potentially affecting consumer trust and market dynamics.