What's Happening?

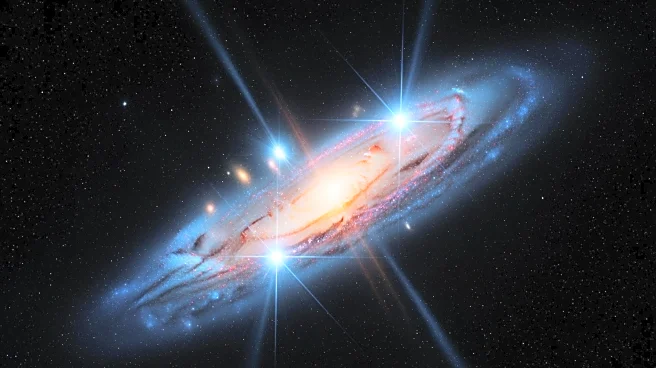

The oil market is currently experiencing a false sense of security despite ongoing geopolitical tensions, particularly between the United States and Iran. Recent threats of military escalation have pushed Brent crude prices past $67 per barrel. Analysts

warn that geopolitical risks, such as potential conflicts in the Middle East, could still lead to significant price shocks. The Strait of Hormuz, a critical chokepoint for global oil supply, remains a potential flashpoint. While U.S. shale production has altered market dynamics, the possibility of disruptions in oil supply due to geopolitical events remains a concern. Rystad Energy has outlined several scenarios regarding U.S.-Iran relations, with outcomes ranging from diplomatic resolutions to military conflicts, each with varying impacts on oil prices.

Why It's Important?

The underestimation of geopolitical risks in the oil market could lead to unexpected price volatility, affecting global economies. The potential for conflict in the Middle East, particularly involving Iran, poses a significant threat to oil supply stability. A disruption in the Strait of Hormuz could impact 20% of the global oil supply, leading to substantial price increases. While energy efficiency has improved, reducing the economic impact of oil price shocks, crude oil remains a vital energy source. The situation highlights the need for strategic planning and risk management in the energy sector to mitigate the effects of geopolitical tensions.

What's Next?

The future of oil prices will largely depend on the developments in U.S.-Iran relations. Diplomatic efforts could lead to a new nuclear deal, potentially increasing Iran's oil production and stabilizing prices. However, the risk of military conflict remains, which could disrupt oil supplies and drive prices higher. The global oil market will need to monitor these geopolitical developments closely and prepare for potential disruptions. Additionally, countries may seek to diversify their energy sources and increase strategic reserves to mitigate the impact of future price shocks.