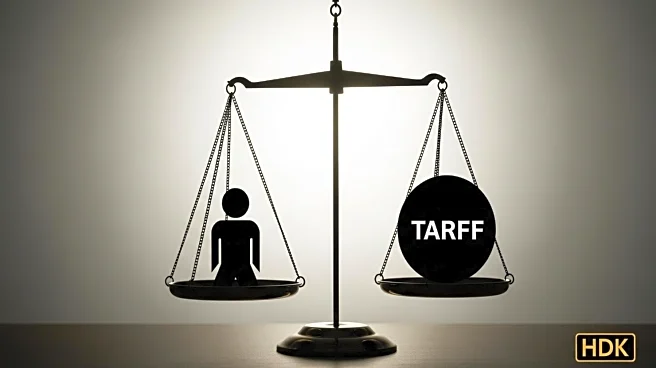

What's Happening?

Goldman Sachs economists have reported that U.S. consumers are expected to absorb 55% of the costs associated with tariffs imposed by President Trump. According to a research note from Goldman Sachs, American companies will take on 22% of the tariff costs, while foreign exporters will absorb 18% by reducing their prices. The report highlights that U.S. businesses are currently bearing a larger share of the costs, but as prices adjust, consumers will eventually face higher costs. The tariffs have already increased core personal consumption expenditure prices by 0.44% this year, with inflation expected to reach 3% by December. President Trump has implemented these tariffs as part of his strategy to close trade gaps and boost domestic manufacturing, although he has previously criticized Goldman Sachs for similar analyses.

Why It's Important?

The findings from Goldman Sachs underscore the significant impact of tariffs on U.S. consumers, who are likely to face increased prices as companies pass on the costs. This situation could lead to higher inflation rates, affecting purchasing power and economic stability. The tariffs are part of President Trump's broader trade strategy, which aims to protect domestic industries but may inadvertently burden consumers. The report also suggests that foreign exporters are adjusting their pricing strategies to maintain market share, indicating potential shifts in global trade dynamics. As tariffs continue to influence economic indicators, stakeholders such as businesses and policymakers must navigate the complexities of trade policies and their implications for the U.S. economy.

What's Next?

The Goldman Sachs report does not account for President Trump's recent threats to increase tariffs on China to 100% and impose restrictions on critical U.S. software exports. These potential changes could further escalate trade tensions and impact economic relations between the U.S. and China. As the situation evolves, businesses may need to reassess their pricing strategies and supply chain operations to mitigate the effects of tariffs. Policymakers and industry leaders will likely continue to monitor the economic indicators and adjust their approaches to trade negotiations and domestic economic policies. The ongoing developments in trade policy could lead to further adjustments in consumer prices and inflation rates.

Beyond the Headlines

The tariff situation raises ethical and economic questions about the balance between protecting domestic industries and the financial burden placed on consumers. The long-term implications of these trade policies could influence consumer behavior, potentially leading to shifts in spending patterns and economic priorities. Additionally, the dynamics between U.S. and foreign exporters may evolve as companies seek to maintain competitiveness in a changing trade environment. The broader cultural and economic impacts of these tariffs could shape future policy decisions and international trade relations.