What's Happening?

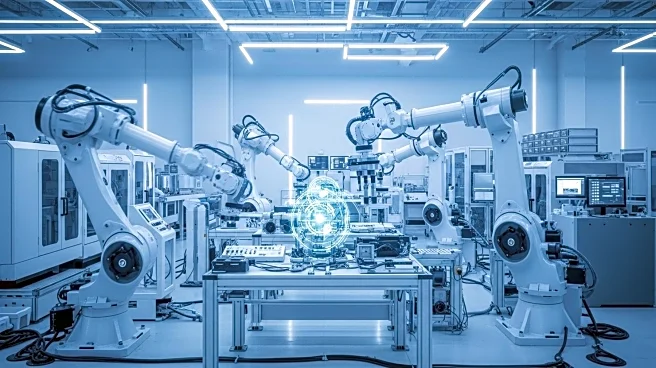

The US manufacturing sector has significantly contributed to a rebound in foreign direct investment (FDI) during the second quarter of 2025, according to the Bureau of Economic Analysis. Foreign producers invested $51.1 billion, marking a substantial increase from previous quarters. The chemicals and metals industries were particularly active, while IT investments also saw growth. However, automotive and transport investments declined. Japan and the UK were major contributors, with European and Asian investors leading the way. The Global Business Alliance highlights the benefits of these investments, including job creation and support for US operations.

Why It's Important?

The surge in FDI underscores the importance of the manufacturing sector in driving economic growth and job creation in the US. These investments not only bolster existing operations but also fund research and development, enhancing the country's competitive edge. The involvement of international firms in building new factories and expanding operations supports the US economy by employing millions of Americans in well-paying jobs. The rebound in FDI reflects confidence in the US market and its potential for growth, particularly in manufacturing and technology sectors.

What's Next?

The continued influx of foreign investments is expected to impact future economic data, with new projects like Woodside Energy's LNG facility in Louisiana set to contribute significantly. As foreign investors commit to major projects, the US may see further growth in manufacturing and related industries. Policymakers and industry leaders will likely focus on maintaining favorable conditions for FDI, ensuring the US remains an attractive destination for international capital.

Beyond the Headlines

The rebound in FDI highlights the global interconnectedness of economies and the role of international investments in shaping domestic markets. It raises considerations about the balance between foreign influence and domestic economic priorities. The trend may prompt discussions on regulatory frameworks and policies to optimize the benefits of FDI while safeguarding national interests.