What's Happening?

Morgan Stanley has downgraded several hardware companies, including Dell and Hewlett Packard Enterprise (HPE), due to concerns over rising memory costs. Dell was downgraded from overweight to underweight, while HPE was downgraded from overweight to equal

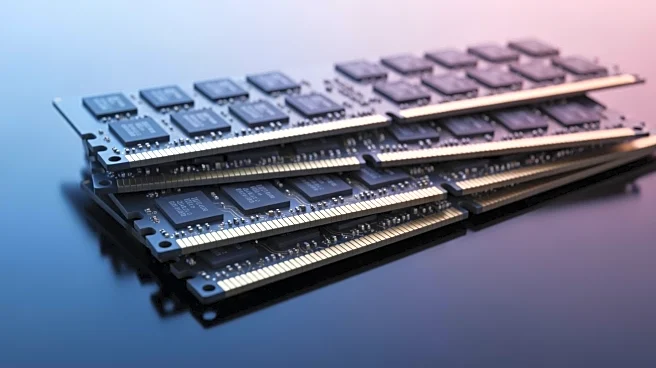

weight. The downgrades come as hyperscalers accelerate data center demand, pushing hardware valuations to all-time highs. Rising costs in DRAM and NAND memory are expected to pressure margins, with memory fulfillment rates potentially falling as low as 40% over the next two quarters. Analysts warn that this poses a significant risk to earnings estimates for the global hardware OEM/ODM universe.

Why It's Important?

The downgrades reflect broader concerns about the impact of rising memory costs on the tech industry. As memory accounts for a substantial portion of product costs, companies may face compressed margins and increased financial pressure. This situation could lead to higher prices for consumer products and affect the competitiveness of hardware manufacturers. The downgrades also highlight the challenges faced by companies in adapting to the evolving market dynamics driven by AI infrastructure demand.

What's Next?

Hardware companies may need to reassess their pricing strategies and explore cost-saving measures to mitigate the impact of rising memory costs. Stakeholders will likely monitor developments closely, as the situation could influence investment decisions and market dynamics in the tech industry. The focus will be on how companies navigate these challenges and adapt to the changing landscape.