What is the story about?

What's Happening?

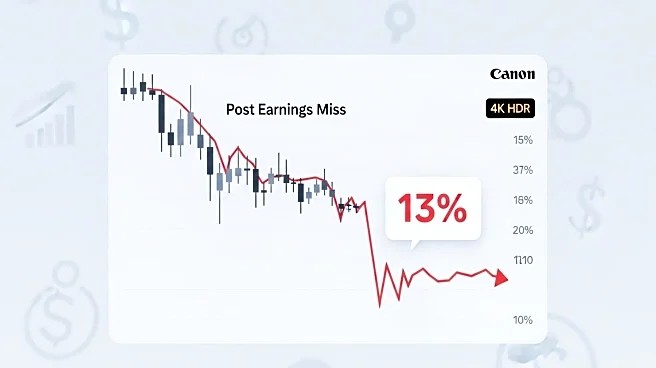

Figma's stock fell over 13% in pre-market trading after the company reported its first quarterly results since its IPO on July 31, 2025. The company missed both sales and earnings expectations for the second quarter of fiscal 2025, leading to a decline in its share price. Figma, a cloud-based design platform used for UI and UX design, had a successful IPO with shares initially rising over 333% from the offering price. However, the stock has since declined by 44.2% from its market debut. In the second quarter, Figma's sales increased 41% year-over-year to $249.64 million, slightly below the consensus estimate of $250 million. The company reported break-even earnings per share, while analysts had projected a profit of $0.09 per share. Despite the earnings miss, CEO Dylan Field expressed optimism about the company's future, citing strong customer loyalty and the successful launch of new products.

Why It's Important?

The earnings miss and subsequent stock drop highlight investor concerns about Figma's ability to meet market expectations post-IPO. As a leader in UI/UX design software, Figma's performance is closely watched by investors and analysts. The company's strong customer retention rates and new product launches suggest potential for future growth, but the current share price and earnings miss may limit near-term upside. Analysts have given Figma a Hold consensus rating, indicating cautious optimism about its future prospects. The company's ability to align its sales projections with market expectations will be crucial in maintaining investor confidence.

What's Next?

Figma has projected sales between $263 million and $265 million for the third quarter, slightly above the consensus estimate. For the full fiscal year 2025, the company expects sales between $1.021 billion and $1.025 billion, aligning with market expectations. Analysts may update their forecasts based on the latest earnings report, which could impact Figma's stock rating and price target. The company's focus on customer loyalty and product innovation will be key factors in its ability to recover from the earnings miss and improve its market position.